How To Categorize Owner's Draw In Quickbooks Online

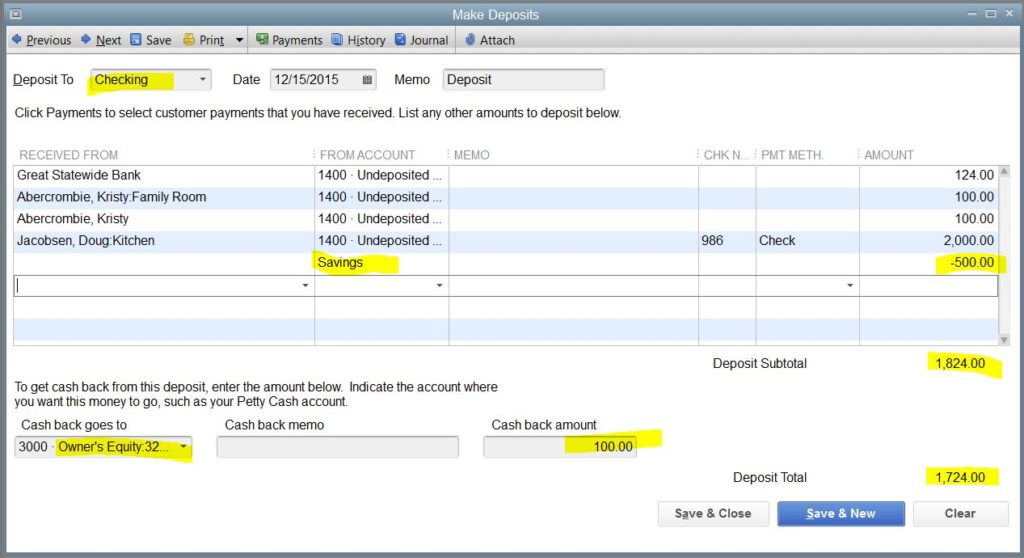

How To Categorize Owner's Draw In Quickbooks Online - In quickbooks desktop application, you can simply set up or categorize. Guide to set up owner’s draw in quickbooks desktop. To record an owner’s draw in quickbooks online (qbo), follow these steps: Go to the “banking” tab and select “make a. If you're a sole proprietor, you must be paid with an. Learn how to pay an owner of a sole proprietor business in quickbooks online. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal.

To record an owner’s draw in quickbooks online (qbo), follow these steps: Go to the “banking” tab and select “make a. In quickbooks desktop application, you can simply set up or categorize. Learn how to pay an owner of a sole proprietor business in quickbooks online. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. If you're a sole proprietor, you must be paid with an. Guide to set up owner’s draw in quickbooks desktop.

Guide to set up owner’s draw in quickbooks desktop. Learn how to pay an owner of a sole proprietor business in quickbooks online. Go to the “banking” tab and select “make a. To record an owner’s draw in quickbooks online (qbo), follow these steps: To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. If you're a sole proprietor, you must be paid with an. In quickbooks desktop application, you can simply set up or categorize.

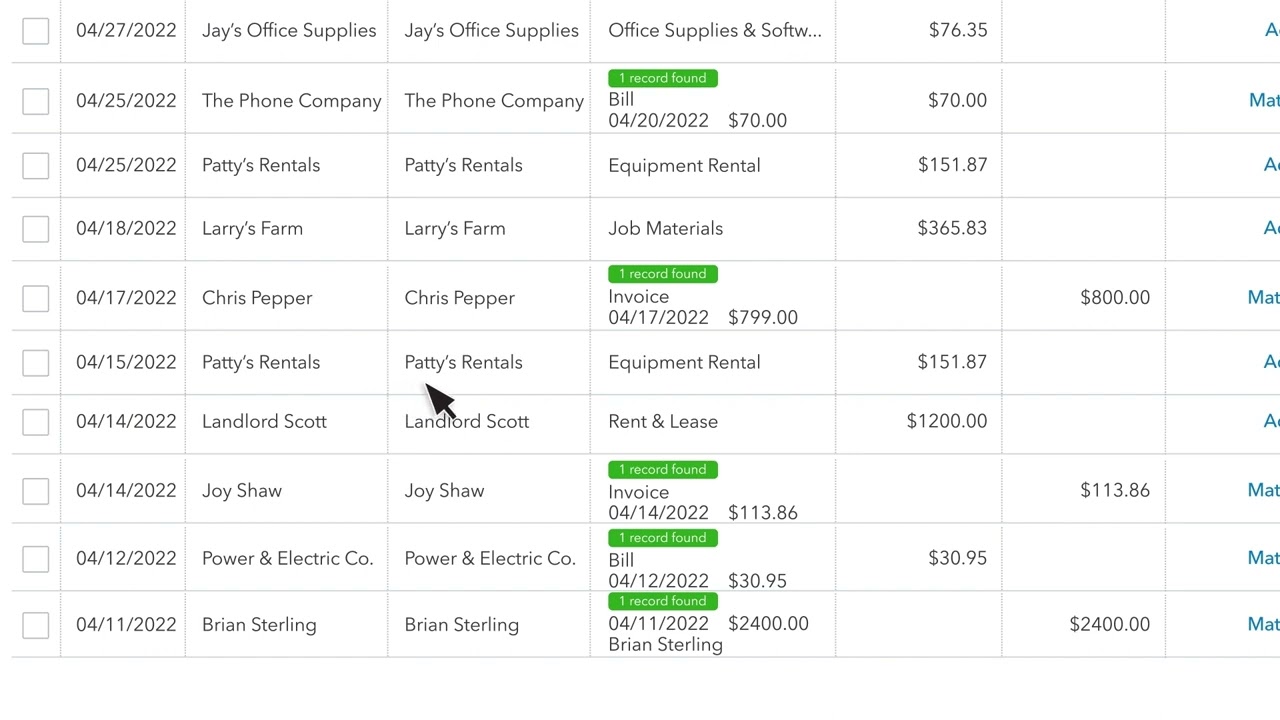

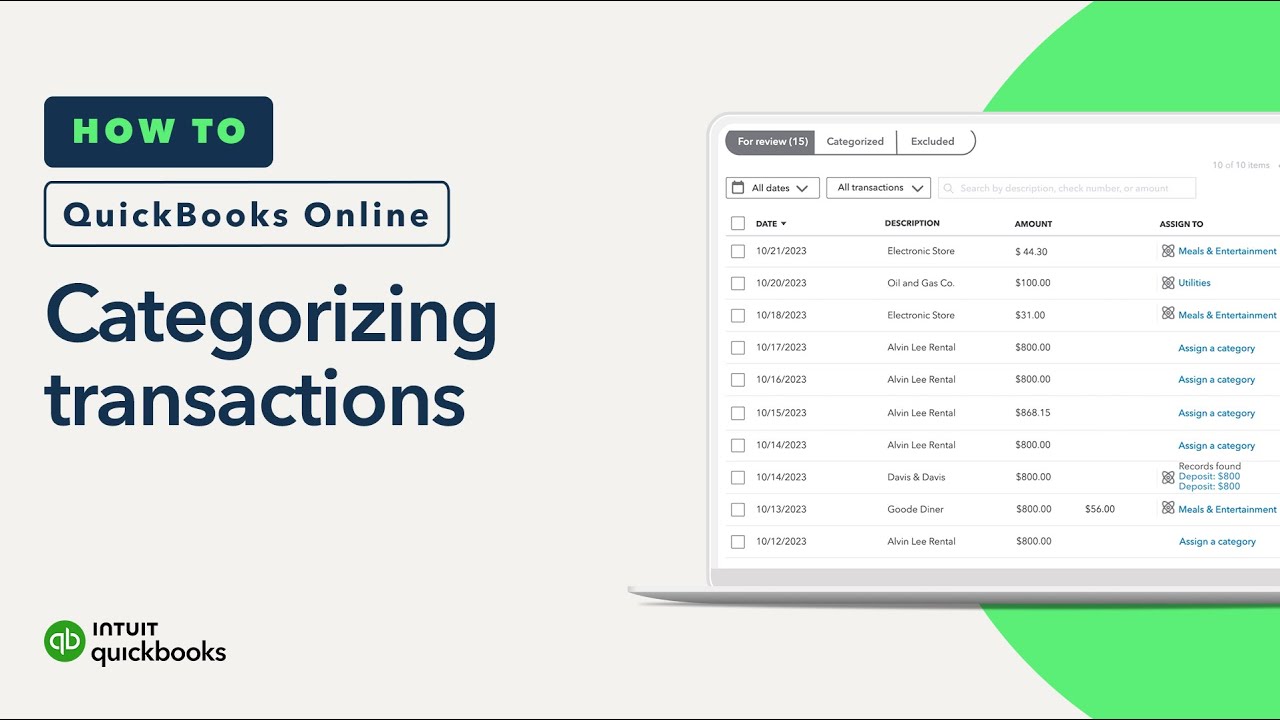

How To Categorize Transactions In QuickBooks Online QBO Tutorial

Go to the “banking” tab and select “make a. In quickbooks desktop application, you can simply set up or categorize. Learn how to pay an owner of a sole proprietor business in quickbooks online. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. If you're a sole.

How To Complete An Owner's Draw In QuickBooks Online QBO Tutorial

In quickbooks desktop application, you can simply set up or categorize. To record an owner’s draw in quickbooks online (qbo), follow these steps: To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Learn how to pay an owner of a sole proprietor business in quickbooks online. Guide.

how to take an owner's draw in quickbooks Masako Arndt

Learn how to pay an owner of a sole proprietor business in quickbooks online. Guide to set up owner’s draw in quickbooks desktop. If you're a sole proprietor, you must be paid with an. To record an owner’s draw in quickbooks online (qbo), follow these steps: In quickbooks desktop application, you can simply set up or categorize.

How to Categorise Transactions in QuickBooks Online Introduction to

Guide to set up owner’s draw in quickbooks desktop. To record an owner’s draw in quickbooks online (qbo), follow these steps: If you're a sole proprietor, you must be paid with an. Learn how to pay an owner of a sole proprietor business in quickbooks online. Go to the “banking” tab and select “make a.

Learn How to Record an Owner's Draw in QuickBooks Online A Training

In quickbooks desktop application, you can simply set up or categorize. Guide to set up owner’s draw in quickbooks desktop. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. To record an owner’s draw in quickbooks online (qbo), follow these steps: Learn how to pay an owner.

How to categorize transactions in QuickBooks Online Booke AI

Guide to set up owner’s draw in quickbooks desktop. Go to the “banking” tab and select “make a. Learn how to pay an owner of a sole proprietor business in quickbooks online. In quickbooks desktop application, you can simply set up or categorize. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity.

Solved TRANSACTION DETAIL BY ACCOUNT REPORT

Go to the “banking” tab and select “make a. If you're a sole proprietor, you must be paid with an. Guide to set up owner’s draw in quickbooks desktop. In quickbooks desktop application, you can simply set up or categorize. Learn how to pay an owner of a sole proprietor business in quickbooks online.

How to Categorize Owner Distribution in QuickBooks?

Guide to set up owner’s draw in quickbooks desktop. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Go to the “banking” tab and select “make a. To record an owner’s draw in quickbooks online (qbo), follow these steps: In quickbooks desktop application, you can simply set.

How to categorize transactions in QuickBooks Online YouTube

In quickbooks desktop application, you can simply set up or categorize. Go to the “banking” tab and select “make a. Guide to set up owner’s draw in quickbooks desktop. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. To record an owner’s draw in quickbooks online (qbo),.

How to Categorize Transactions in QuickBooks

To record an owner’s draw in quickbooks online (qbo), follow these steps: In quickbooks desktop application, you can simply set up or categorize. Go to the “banking” tab and select “make a. If you're a sole proprietor, you must be paid with an. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity.

To Record An Owner’s Draw In Quickbooks Online (Qbo), Follow These Steps:

Learn how to pay an owner of a sole proprietor business in quickbooks online. In quickbooks desktop application, you can simply set up or categorize. Guide to set up owner’s draw in quickbooks desktop. Go to the “banking” tab and select “make a.

To Properly Record An Owner’s Draw In Quickbooks, It Is Essential To Create A Dedicated Owner’s Equity Account To Track The Withdrawal.

If you're a sole proprietor, you must be paid with an.