Quickbooks Owner's Investment

Quickbooks Owner's Investment - Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. Learn how to record capital investments to track money going into your business. With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business.

With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. Learn how to record capital investments to track money going into your business. With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business.

how to take an owner's draw in quickbooks Masako Arndt

You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. With quickbooks online, you can. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

5 Reasons Why Small Business Owners Should Use QuickBooks Payroll Sonary

You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. With quickbooks online, you can.

How to Calculate Owner's Equity in QuickBooks

With quickbooks online, you can. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. Learn how to record capital investments to track money going into your business. You can keep track of personal funds used to pay bills or start a business.

How to Deal with Owner Investment and Spending in Quickbooks Online

Learn how to record capital investments to track money going into your business. You can keep track of personal funds used to pay bills or start a business. With quickbooks online, you can. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

How to Use QuickBooks Online StepByStep Guide Tips & Setup

Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. Learn how to record capital investments to track money going into your business. With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business.

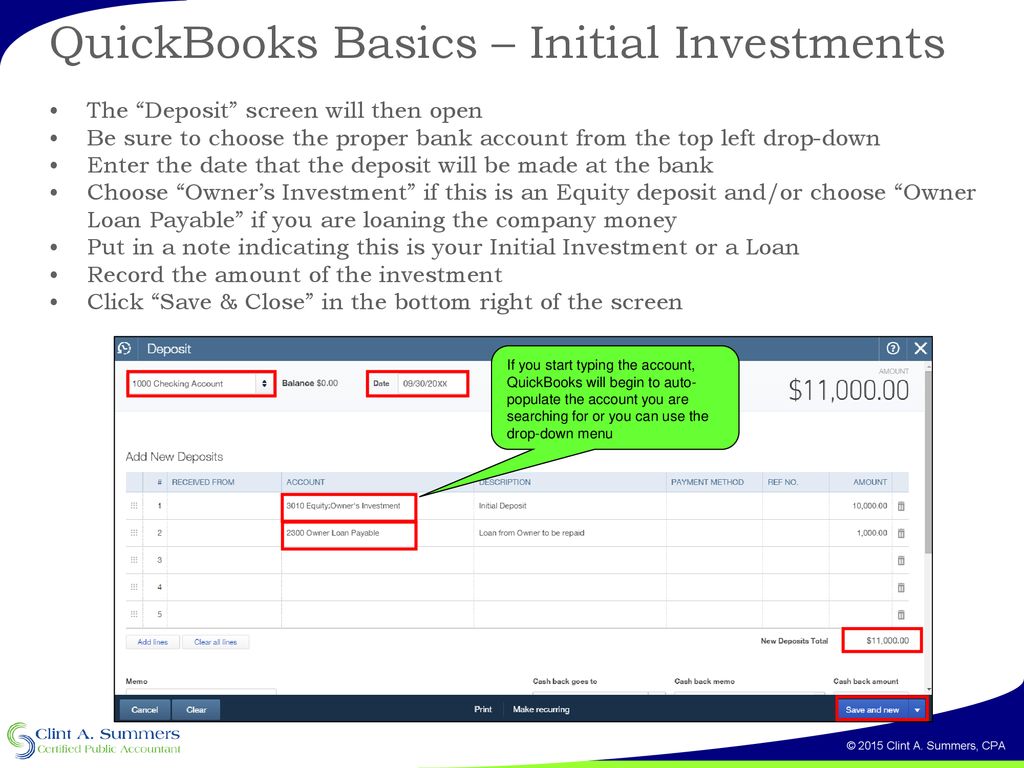

QuickBooks Training. ppt download

You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. With quickbooks online, you can. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

How to record business expenses paid for with owner funds in QuickBooks

Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. With quickbooks online, you can.

How To Record Investment In Quickbooks? Retire Gen Z

Learn how to record capital investments to track money going into your business. With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

QuickBooks Customers List QuickBooks Users Email List

You can keep track of personal funds used to pay bills or start a business. With quickbooks online, you can. Learn how to record capital investments to track money going into your business. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

Comparison QuickBooks Vs. QuickBooks Enterprise Aenten US

With quickbooks online, you can. You can keep track of personal funds used to pay bills or start a business. Learn how to record capital investments to track money going into your business. Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper.

Learn How To Record Capital Investments To Track Money Going Into Your Business.

Recording an owner’s investment in quickbooks requires specific steps to document the infusion of capital into the business and ensure proper. You can keep track of personal funds used to pay bills or start a business. With quickbooks online, you can.