Adjusting Payroll Liabilities In Quickbooks Desktop

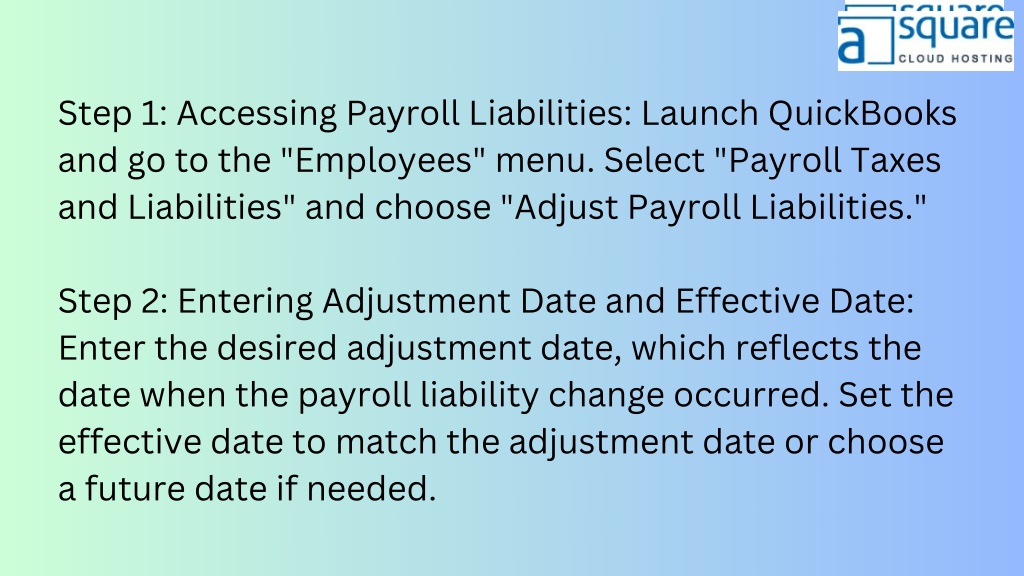

Adjusting Payroll Liabilities In Quickbooks Desktop - Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of.

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities.

Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities.

How To Track, Record and Pay Payroll Liabilities in QuickBooks Desktop

Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and.

Adjusting Payroll Liabilities in QuickBooks Made Easy Expert Tips

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities.

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

Choose adjust payroll liabilities and pick the last paycheck date of. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and.

QuickBooks Desktop Paying Payroll Liabilities YouTube

Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and.

PPT How to Adjust Payroll Liabilities in QuickBooks [Explained

Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Choose adjust payroll liabilities and pick the last paycheck date of.

Solved Payroll liabilities

Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently.

PPT How to Adjust Payroll Liabilities in QuickBooks [Explained

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of.

Quickbooks Payroll Desktop 2024 Lona Martie

Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently.

8.8 Paying and Adjusting Payroll Liabilities Aptora Support

Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently.

How to Adjust Payroll Liabilities in QuickBooks Desktop

Looking to adjust payroll liabilities in quickbooks, try these tricks & tips that no one tells you to run or update payroll efficiently. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities.

Looking To Adjust Payroll Liabilities In Quickbooks, Try These Tricks & Tips That No One Tells You To Run Or Update Payroll Efficiently.

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities.