Airbnb Tax Reporting

Airbnb Tax Reporting - As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing.

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing.

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Dive into the essentials of managing your rental income, maximizing. Everything airbnb hosts in the us need to know about taxes!

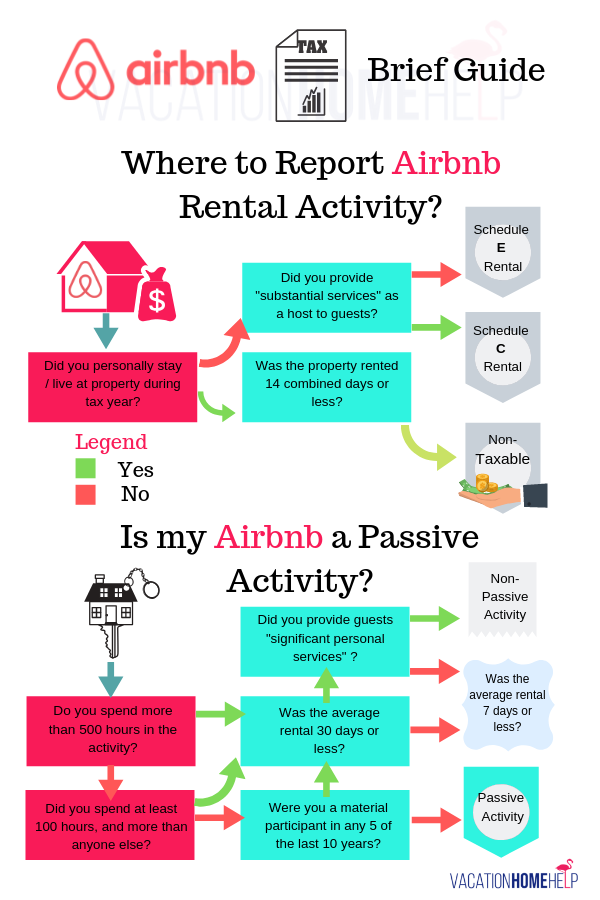

Airbnb Host Reporting Guide

Everything airbnb hosts in the us need to know about taxes! As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Dive into the essentials of managing your rental income, maximizing.

Airbnb Taxes What taxes do I need to collect on my Airbnb bookings?

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing.

Airbnb Tax Preparation & Reporting Everything You Need to Know!

Dive into the essentials of managing your rental income, maximizing. Everything airbnb hosts in the us need to know about taxes! As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs.

Airbnb Schedule C or E How to report your Airbnb Taxes Taxed Right

Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing. As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs.

An Airbnb Tax Will One Solve the Housing Crisis? — The Latch

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing.

Airbnb Tax in Ireland Explained Cronin & Co

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Dive into the essentials of managing your rental income, maximizing. Everything airbnb hosts in the us need to know about taxes!

Airbnb Taxes and Tax Reporting Tips YouTube

Dive into the essentials of managing your rental income, maximizing. Everything airbnb hosts in the us need to know about taxes! As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs.

Airbnb Taxes Every Host Should Know Real Estate Tax Tips

Everything airbnb hosts in the us need to know about taxes! Dive into the essentials of managing your rental income, maximizing. As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs.

Accounting for Artists, Freelancers & Creative Companies Tips for

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Dive into the essentials of managing your rental income, maximizing. Everything airbnb hosts in the us need to know about taxes!

Accounting for Artists, Freelancers & Creative Companies Tips for

Dive into the essentials of managing your rental income, maximizing. As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes!

Dive Into The Essentials Of Managing Your Rental Income, Maximizing.

As an independent contractor for airbnb, you have to file a 1099 tax form for your gross earnings to the irs. Everything airbnb hosts in the us need to know about taxes!