Airbnb Write Offs

Airbnb Write Offs - Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. The lockbox you bought so guests can enjoy contactless entry? Buying social media ads to market your listing? It belongs on your schedule c! If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. With this free ebook by. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable.

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. The lockbox you bought so guests can enjoy contactless entry? Buying social media ads to market your listing? It belongs on your schedule c! With this free ebook by.

The lockbox you bought so guests can enjoy contactless entry? It belongs on your schedule c! If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. Buying social media ads to market your listing? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. With this free ebook by.

How Airbnb Lets Me Live RentFree The Digital Sharecropper

The lockbox you bought so guests can enjoy contactless entry? With this free ebook by. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. It belongs on your schedule c! If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to.

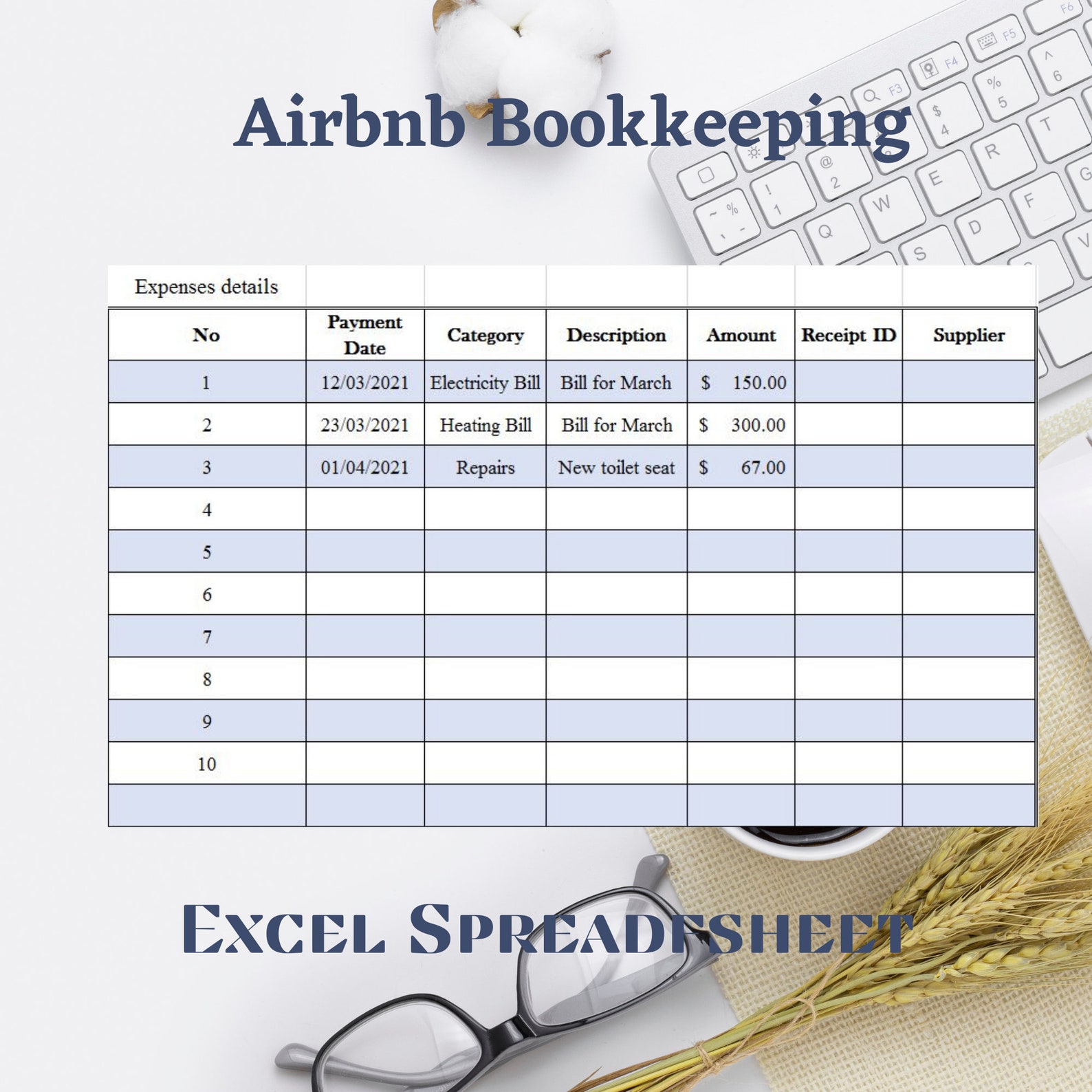

Airbnb Rental & Expense Spreadsheet Tracker

If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: The lockbox you bought so guests can enjoy contactless entry? Buying social media ads to market your.

How I Increased My Airbnb Revenue as a New Airbnb Host Airbnb App

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. Buying social media ads to market your listing? If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. The lockbox you bought so guests can enjoy contactless entry? Navigating tax deductions as an airbnb host may seem challenging, but understanding.

Do you have an Airbnb rental? Here are Airbnb write offs for your

Buying social media ads to market your listing? The lockbox you bought so guests can enjoy contactless entry? If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. It.

AIRBNB TAX WRITE OFFS TAX DEDUCTIONS FOR YOUR AIRBNB YouTube

If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. With this free ebook by. It belongs.

9 Tax Write Offs for Airbnb Rental Properties YouTube

With this free ebook by. Buying social media ads to market your listing? If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. It belongs on your schedule c! If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax.

Tax Deductions Furniture Writeoffs for Airbnb Hosts Subscribed.FYI

Buying social media ads to market your listing? Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. If you’re hosting a stay, it's possible that not all of your airbnb income is.

Most Airbnb Hosts Don't Accurately Document Their Tax WriteOffs 😱 Demo

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. It belongs on your schedule c! Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records can lead you to. With this free ebook by. If you’re an airbnb host looking to make extra money through short.

Airbnb Rental Property Spreadsheet for up to 6 Properties USD, Rental

The lockbox you bought so guests can enjoy contactless entry? If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: Buying social media ads to market your listing? With this free ebook by. It belongs on your schedule c!

Airbnb Startup Cost—Business Plan

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: Navigating tax deductions as an airbnb host may seem challenging, but understanding the eligible deductions and maintaining proper records.

Navigating Tax Deductions As An Airbnb Host May Seem Challenging, But Understanding The Eligible Deductions And Maintaining Proper Records Can Lead You To.

If you’re an airbnb host looking to make extra money through short term rentals, you’re going to want to pay extra attention to these tax write offs: The lockbox you bought so guests can enjoy contactless entry? With this free ebook by. Buying social media ads to market your listing?

Deductible Items May Include Rent, Mortgage, Cleaning Fees, Rental Commissions, Insurance, And Other Expenses.

It belongs on your schedule c! If you’re hosting a stay, it's possible that not all of your airbnb income is taxable.