Does Airbnb Issue 1099

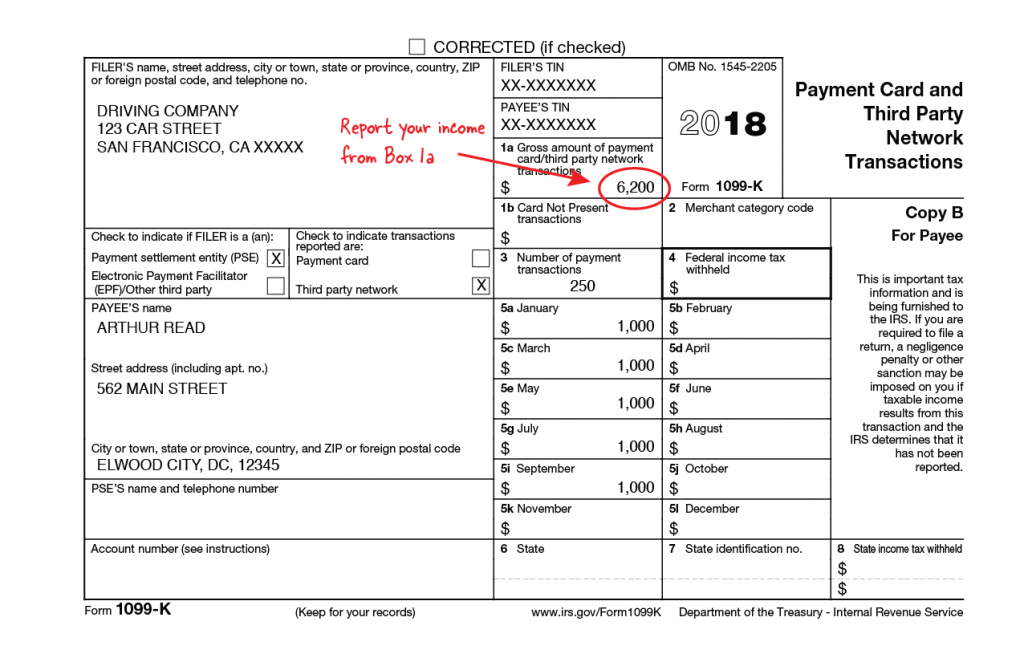

Does Airbnb Issue 1099 - Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

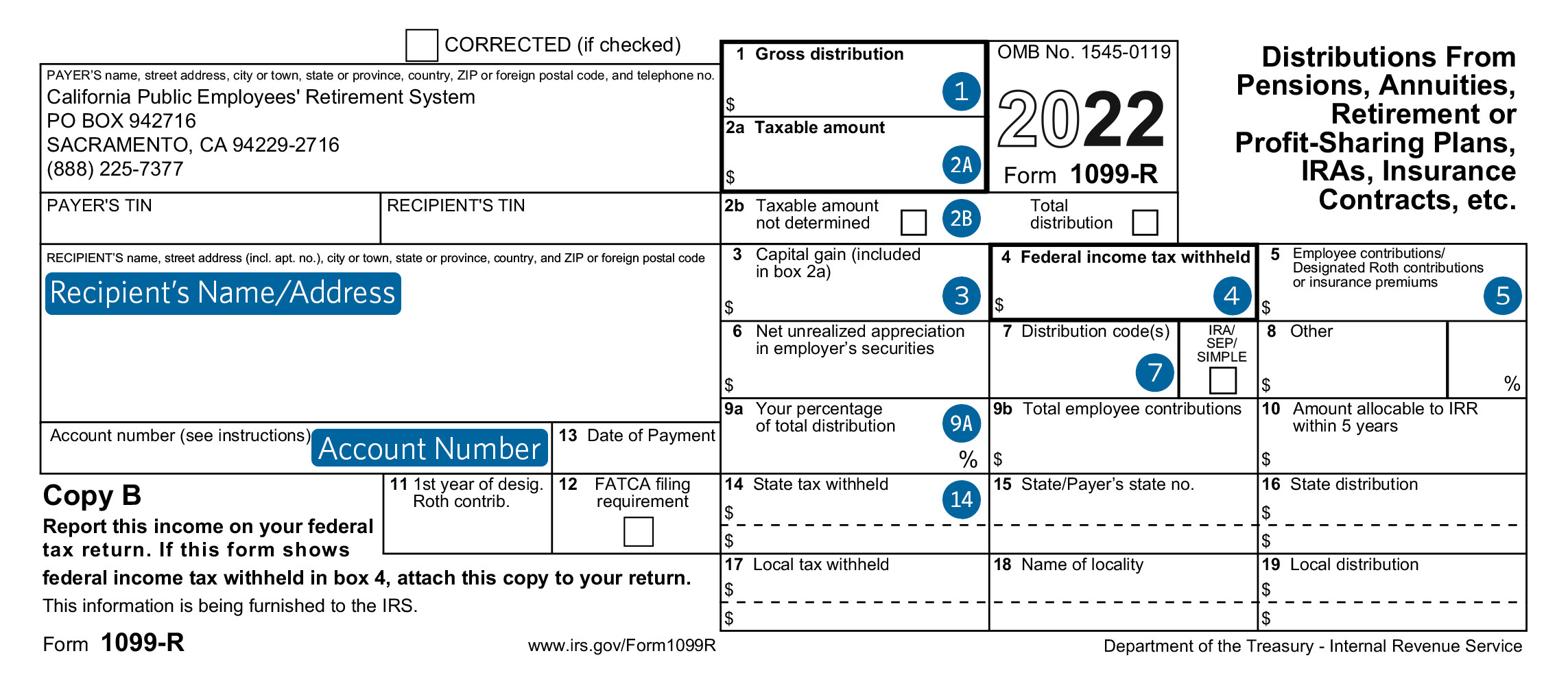

How does a 1099 affect your tax return? Leia aqui How much does a 1099

Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

How To Get Airbnb Tax 1099 Forms 🔴 YouTube

Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes.

What Is a 1099K? — Stride Blog

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.

What Is A 1099 Form—and How Does It Affect Your Expat, 52 OFF

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

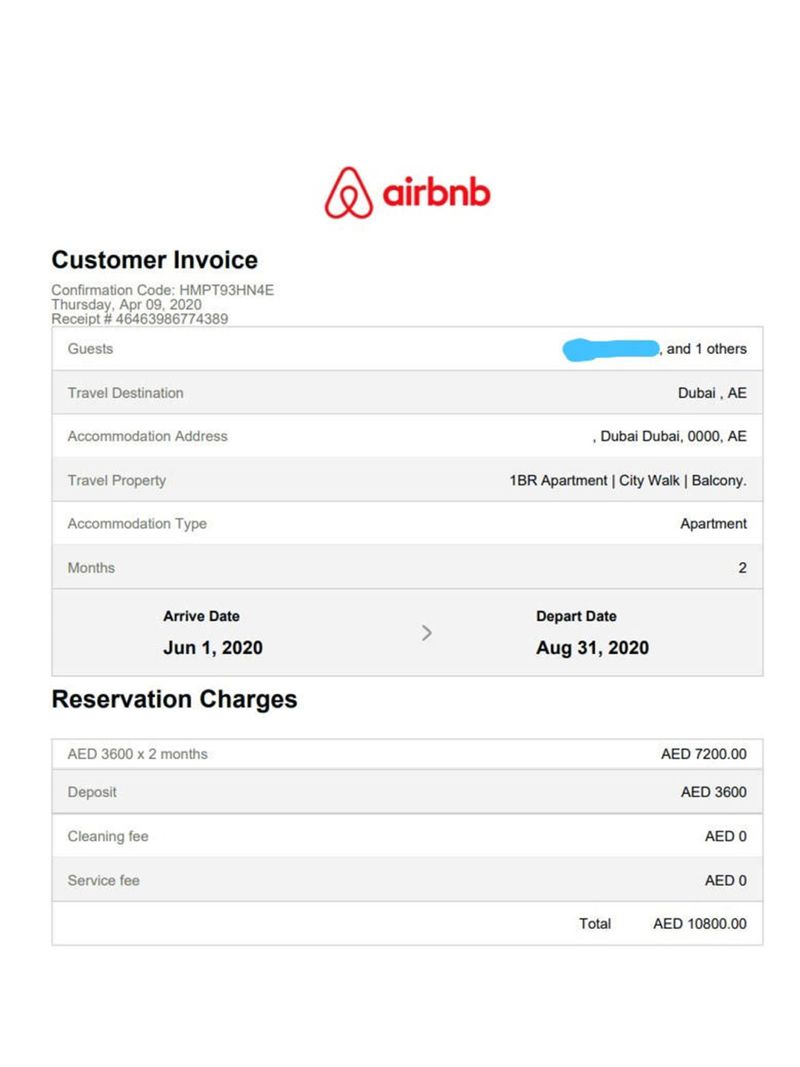

Airbnb Confirmation Email Template

Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes.

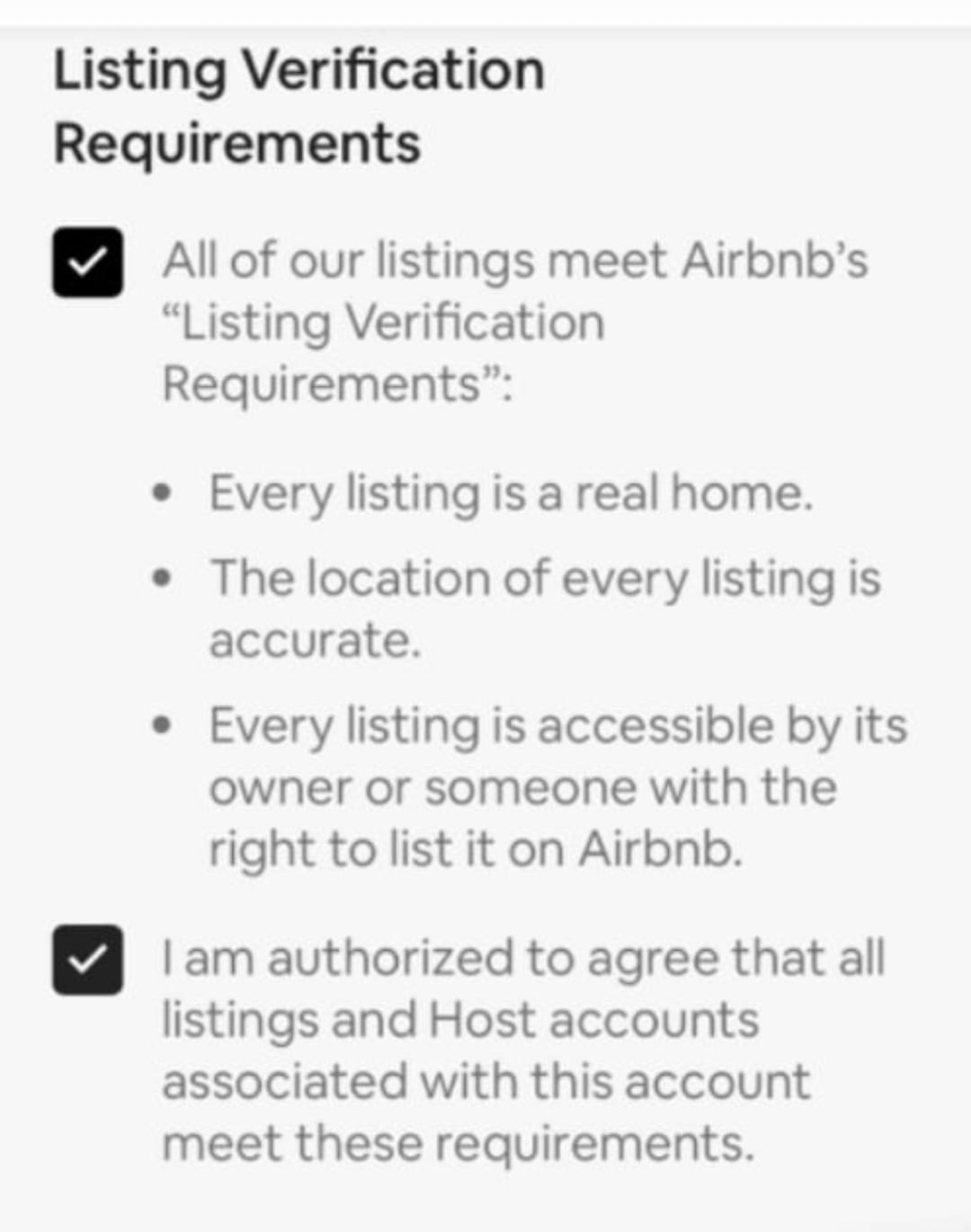

Airbnb’s New Listing Verification Process Favors Pro Hosts

Discover how to report your airbnb 1099 rental business income on your taxes. Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense.

Airbnb Issues 2024 Megan Sibylle

Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

How to file a 1099 form for vendors, contractors, and freelancers

Discover how to report your airbnb 1099 rental business income on your taxes. Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense.

Currently, This Threshhold Is $20,000 And 200 Transactions.

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.