How To Adjust Payroll Liabilities In Quickbooks Online

How To Adjust Payroll Liabilities In Quickbooks Online - The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. Payroll center or chart of. You can directly reach out to our. You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop.

Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. Payroll center or chart of. The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. You can directly reach out to our.

Payroll center or chart of. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. You can directly reach out to our. Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options:

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation

You can directly reach out to our. Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: You will have to fill up certain payrolls liability adjustment fields, such as the effective date,.

How To Adjust Payroll Liabilities In Quickbooks Online

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. You can directly reach out to our. The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. You will.

Quickbooks desktop payroll liabilities locatormusli

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. You can directly reach.

How To Adjust Payroll Liabilities In Quickbooks Online

The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. In this comprehensive guide, we will explore how to.

How To Adjust Payroll Liabilities In Quickbooks Online

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. You can.

Zero Out Payroll Liabilities in QuickBooks (2 DIY Steps )

Payroll center or chart of. The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. You can directly reach out to our. Let's begin by verifying and jotting down the payroll items and amounts you need to adjust using the payroll summary report. In this comprehensive guide, we will explore how to adjust payroll liabilities in.

How to Make Payroll Adjustments in Quickbooks Online StepbyStep

You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. You can directly reach out to.

Solved Payroll liabilities

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. You can directly reach out to our. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. Payroll center or chart.

How to Adjust Payroll Liabilities in QuickBooks Online r/dancingnumbers

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: You can directly reach out to our. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name.

Adjust Payroll Liabilities in QuickBooks How Does it Help? by Account

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: You will have to fill up certain payrolls liability adjustment fields, such as the effective date, item name and many others. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. The option to adjust.

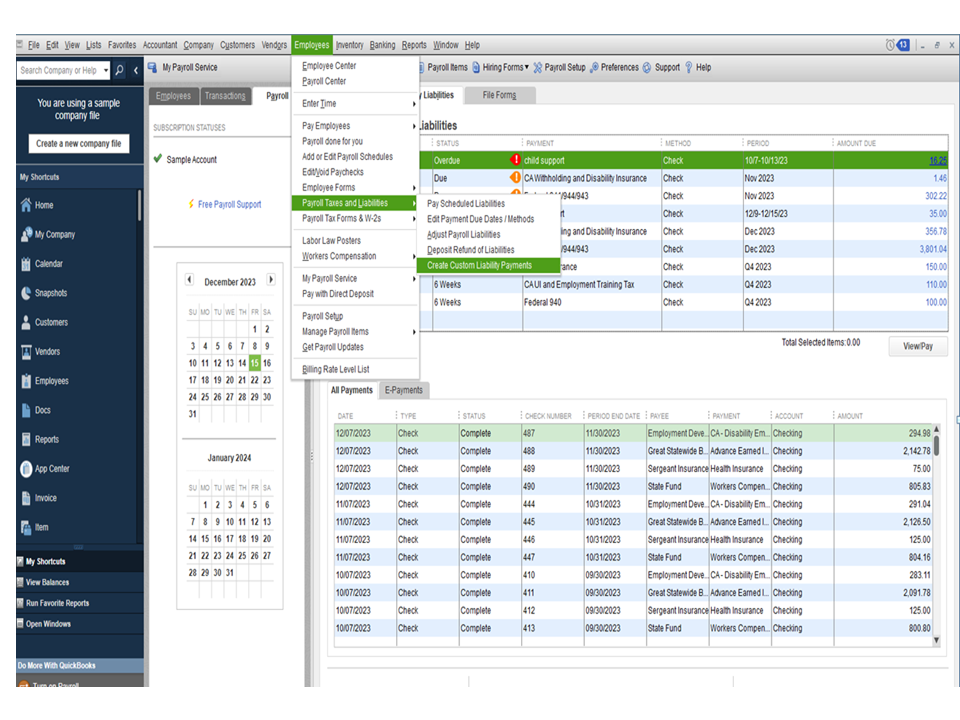

You Will Have To Fill Up Certain Payrolls Liability Adjustment Fields, Such As The Effective Date, Item Name And Many Others.

The option to adjust payroll tax liabilities is unavailable in quickbooks online (qbo) payroll. You can directly reach out to our. In this comprehensive guide, we will explore how to adjust payroll liabilities in quickbooks, quickbooks online, and quickbooks desktop. Payroll center or chart of.

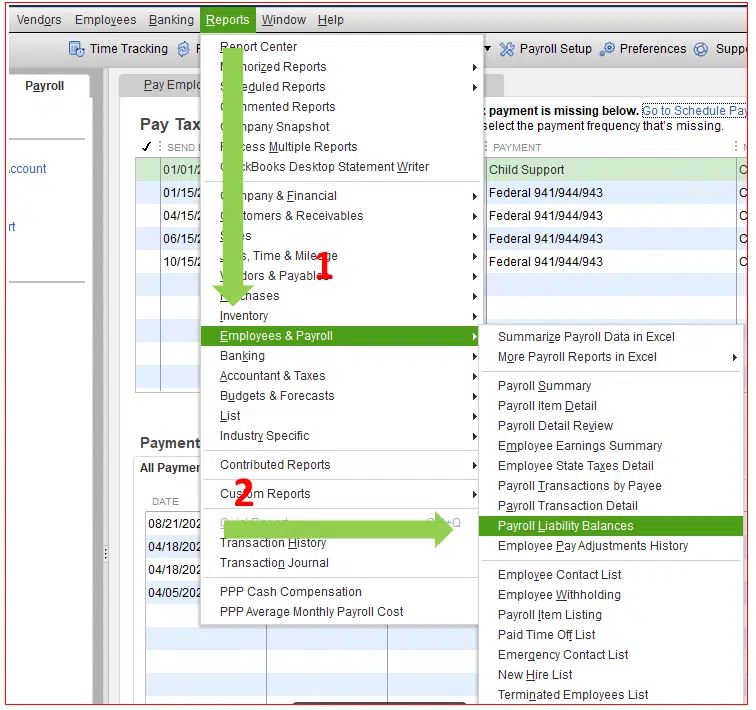

Let's Begin By Verifying And Jotting Down The Payroll Items And Amounts You Need To Adjust Using The Payroll Summary Report.

Learn how to set up, review, and adjust payroll liabilities in quickbooks online with two options: