How To Categorize Client Gifts In Quickbooks

How To Categorize Client Gifts In Quickbooks - In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Let me guide you on how to record gift certificates in quickbooks online, rq. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once you accept gift certificate payments, you agree. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. So, which detail type should be used for client gifts when setting this up in the chart of accounts?

Once you accept gift certificate payments, you agree. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Let me guide you on how to record gift certificates in quickbooks online, rq. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. So, which detail type should be used for client gifts when setting this up in the chart of accounts? Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and.

I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Let me guide you on how to record gift certificates in quickbooks online, rq. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. So, which detail type should be used for client gifts when setting this up in the chart of accounts? Once you accept gift certificate payments, you agree.

How to categorize transactions in QuickBooks Online Booke AI

In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business..

How To Categorize Transactions In Quickbooks

I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. Once.

How to Categorize Transactions in QuickBooks

I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Once you accept gift certificate payments, you agree. In order to assure correct gift documentation, show gratitude to clients, and.

QUICKBOOKS (QBO) HOW TO Categorize transactions in Bank Feeds YouTube

Let me guide you on how to record gift certificates in quickbooks online, rq. So, which detail type should be used for client gifts when setting this up in the chart of accounts? Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients,.

How to Categorize Credit Card Payments in QuickBooks? MWJ Consultancy

Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. I simply create an expense category in the.

How To Categorize Employee Gifts In Quickbooks

Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once you accept gift certificate payments, you agree. In order to assure correct gift documentation, show gratitude to clients,.

How to Categorize Gifts in QuickBooks

Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Once.

How to Categorize Gifts in QuickBooks

So, which detail type should be used for client gifts when setting this up in the chart of accounts? Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Let me guide you on how to record gift certificates in quickbooks online, rq. Once you accept gift certificate payments, you agree. I simply create.

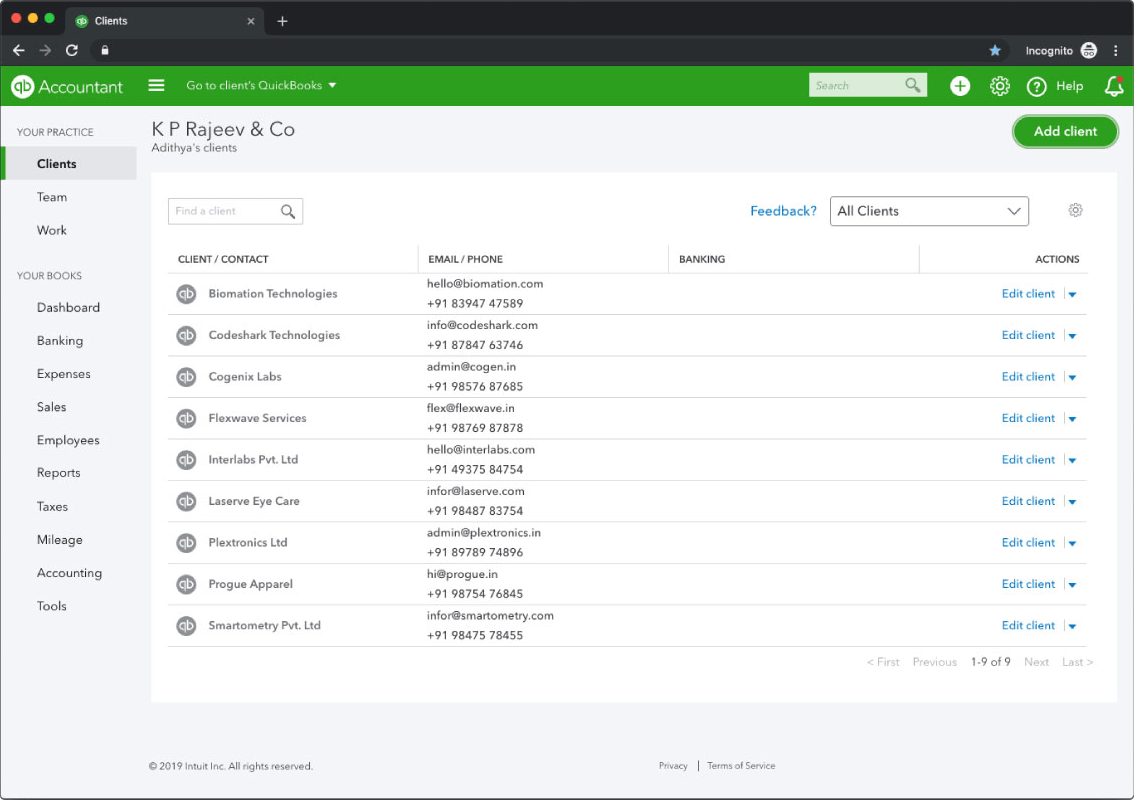

QuickBooks Online Accountant (QBOA) Manage Your Client's Account Easily

In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. I simply create.

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

I simply create an expense category in the chart of accounts for client gifts, much like you would for meals and entertainment (or business. Properly categorizing client gifts in quickbooks is essential for maintaining accurate financial records, ensuring tax compliance, and. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including.

I Simply Create An Expense Category In The Chart Of Accounts For Client Gifts, Much Like You Would For Meals And Entertainment (Or Business.

In order to assure correct gift documentation, show gratitude to clients, and comply with applicable tax rules for company. In this comprehensive guide, we will walk you through the essential steps to categorize different types of gifts, including employee and client. Once you accept gift certificate payments, you agree. So, which detail type should be used for client gifts when setting this up in the chart of accounts?

Properly Categorizing Client Gifts In Quickbooks Is Essential For Maintaining Accurate Financial Records, Ensuring Tax Compliance, And.

Proper categorization of gifts in quickbooks requires a systematic approach to ensure accurate financial records and. Let me guide you on how to record gift certificates in quickbooks online, rq.