Instacart 1099

Instacart 1099 - But the way you get it has changed. If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. Here’s how it works now.

If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. But the way you get it has changed. Here’s how it works now.

If you made over $600 from instacart, you need form 1099. Here’s how it works now. But the way you get it has changed. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities.

Instacart Company Shopper Earnings

If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. Here’s how it works now. But the way you get it has changed.

What You Need To Know About Instacart 1099 Taxes

If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. Here’s how it works now. But the way you get it has changed.

All You Need to Know About Instacart 1099 Taxes

But the way you get it has changed. If you made over $600 from instacart, you need form 1099. Here’s how it works now. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities.

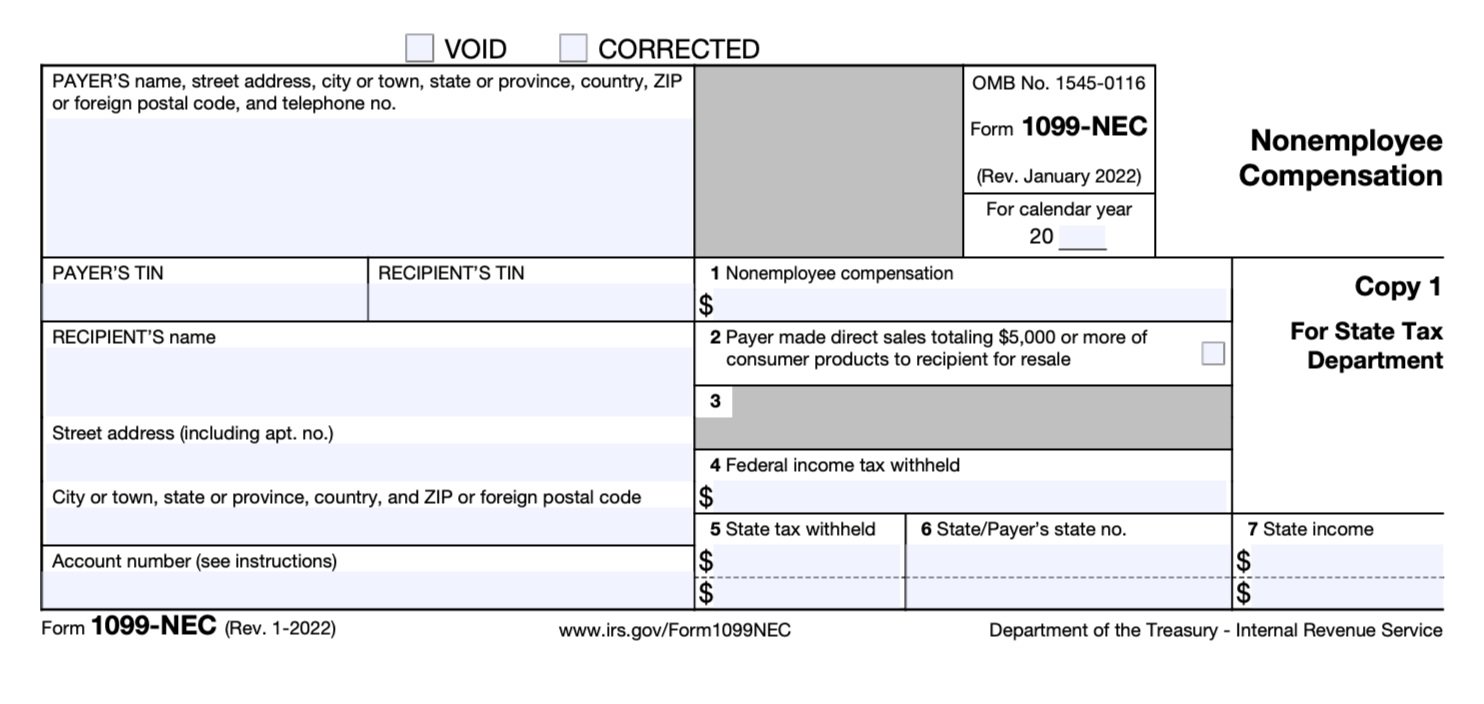

What Is a 1099NEC? — Stride Blog

Here’s how it works now. If you made over $600 from instacart, you need form 1099. But the way you get it has changed. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities.

When Do You Get a 1099 Tax Form and Why Does It Matter?

Here’s how it works now. But the way you get it has changed. If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities.

All Instacart Shoppers Need to Know About Instacart 1099 Tax Forms by

Here’s how it works now. But the way you get it has changed. If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities.

What is a 1099Misc Form? Financial Strategy Center

But the way you get it has changed. If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. Here’s how it works now.

What You Need to Know About Instacart 1099 Taxes in 2024

Here’s how it works now. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. If you made over $600 from instacart, you need form 1099. But the way you get it has changed.

Instacart 1099 Form 2024 Lanae Doralynne

Here’s how it works now. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. If you made over $600 from instacart, you need form 1099. But the way you get it has changed.

Understanding Your Instacart 1099 in 2021 Tax guide, Understanding

If you made over $600 from instacart, you need form 1099. Here’s how it works now. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. But the way you get it has changed.

Here’s How It Works Now.

If you made over $600 from instacart, you need form 1099. Understanding the ins and outs of your 1099 as an instacart shopper keeps you in good standing with tax authorities. But the way you get it has changed.

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)