Is A Credit Card On Apple Pay A Cash Advance

Is A Credit Card On Apple Pay A Cash Advance - As the sender, you use a credit card to fund an apple pay cash transfer. Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. In this case, a 3% fee applies, which is paid by the sender. For example, venmo will charge you 3% fee. I suggest that you contact your credit card issuer. The app will charge you a % fee if you use a credit card instead of a debit card or bank. Apple is coding it as a cash advance rather than a purchase as paypal does. It’s basically just digital use of the card without it.

I suggest that you contact your credit card issuer. Apple is coding it as a cash advance rather than a purchase as paypal does. Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. The app will charge you a % fee if you use a credit card instead of a debit card or bank. As the sender, you use a credit card to fund an apple pay cash transfer. For example, venmo will charge you 3% fee. Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. It’s basically just digital use of the card without it. In this case, a 3% fee applies, which is paid by the sender.

I suggest that you contact your credit card issuer. Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. Apple is coding it as a cash advance rather than a purchase as paypal does. The app will charge you a % fee if you use a credit card instead of a debit card or bank. In this case, a 3% fee applies, which is paid by the sender. It’s basically just digital use of the card without it. As the sender, you use a credit card to fund an apple pay cash transfer. Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. For example, venmo will charge you 3% fee.

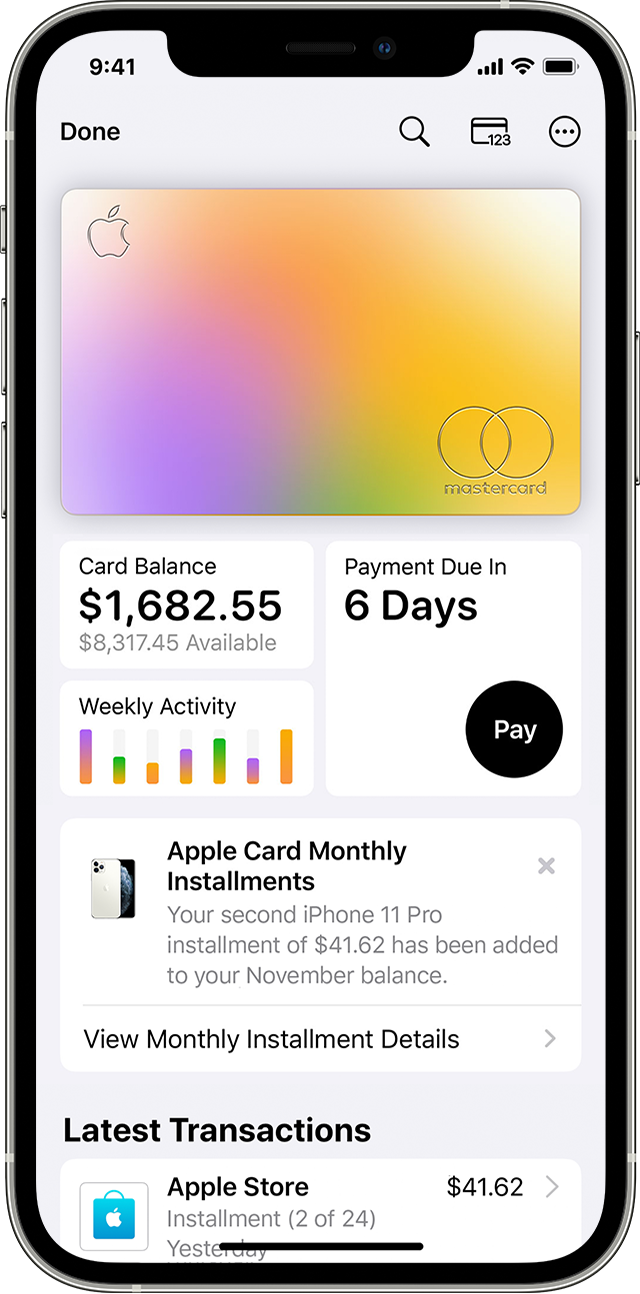

Review The Apple Card can simplify your credit, but it’s not for everyone

Apple is coding it as a cash advance rather than a purchase as paypal does. For example, venmo will charge you 3% fee. The app will charge you a % fee if you use a credit card instead of a debit card or bank. It’s basically just digital use of the card without it. As the sender, you use a.

Bigger Credit Risks Take Bigger Bite From Goldman’s Apple Card

Apple is coding it as a cash advance rather than a purchase as paypal does. As the sender, you use a credit card to fund an apple pay cash transfer. It’s basically just digital use of the card without it. In this case, a 3% fee applies, which is paid by the sender. Using your card with apple pay won’t.

Apple Card review How a credit card can actually be different iMore

In this case, a 3% fee applies, which is paid by the sender. As the sender, you use a credit card to fund an apple pay cash transfer. Apple is coding it as a cash advance rather than a purchase as paypal does. Another user has previously reported, for example, that bank of america treated their apple pay cash payment.

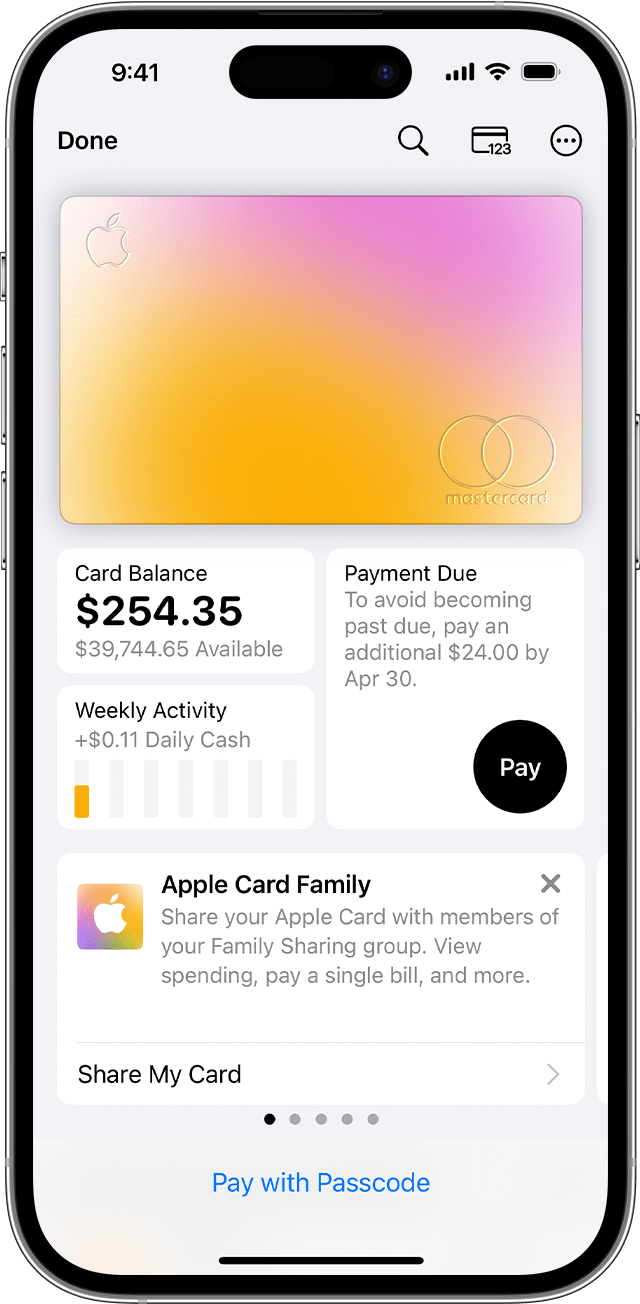

What credit limit does Apple Card start with? Leia aqui What is the

Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. Apple is coding it as a cash advance rather than a purchase as paypal does. In this case, a 3% fee applies, which is paid by the sender. The app will charge you a % fee if you use a credit card instead.

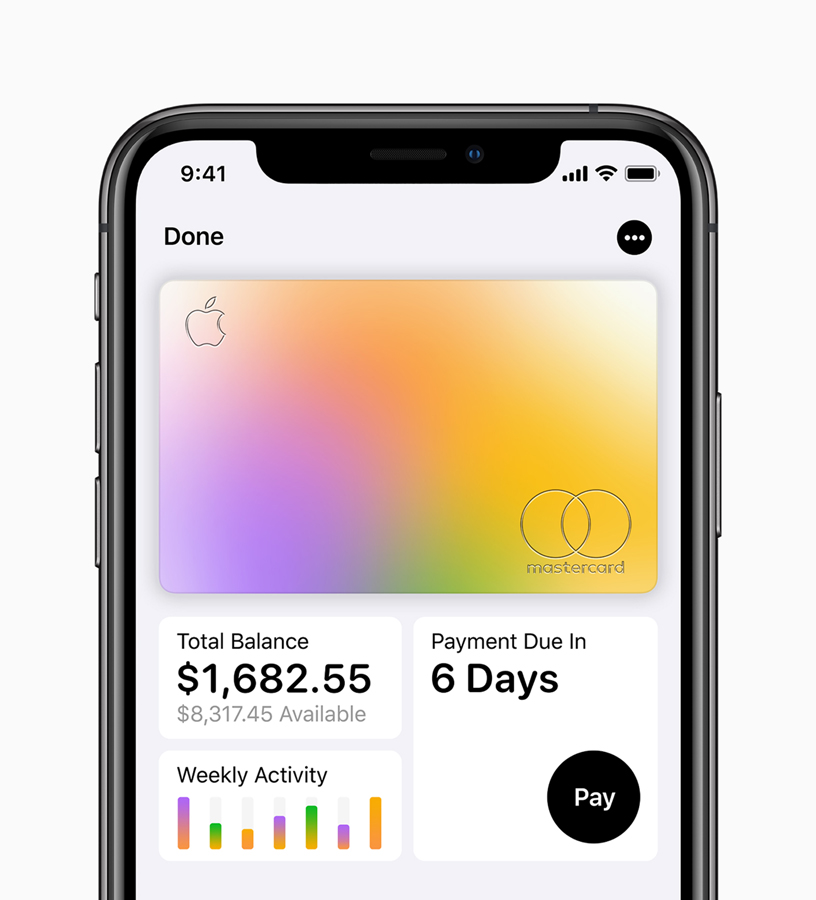

Apple Card Now Available JimmyTech

For example, venmo will charge you 3% fee. As the sender, you use a credit card to fund an apple pay cash transfer. I suggest that you contact your credit card issuer. The app will charge you a % fee if you use a credit card instead of a debit card or bank. It’s basically just digital use of the.

Apple Card Release date, cash back rewards and sign up bonus info

Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. It’s basically just digital use of the card without it. As the sender, you use a credit card to.

How to use Apple Cash How it works and what it costs Macworld

Apple is coding it as a cash advance rather than a purchase as paypal does. As the sender, you use a credit card to fund an apple pay cash transfer. It’s basically just digital use of the card without it. For example, venmo will charge you 3% fee. In this case, a 3% fee applies, which is paid by the.

How to increase your Apple Card credit limit 9to5Mac

As the sender, you use a credit card to fund an apple pay cash transfer. In this case, a 3% fee applies, which is paid by the sender. I suggest that you contact your credit card issuer. For example, venmo will charge you 3% fee. It’s basically just digital use of the card without it.

Apple Introduces Apple Pay Later Apple, 40 OFF

Apple is coding it as a cash advance rather than a purchase as paypal does. It’s basically just digital use of the card without it. The app will charge you a % fee if you use a credit card instead of a debit card or bank. I suggest that you contact your credit card issuer. In this case, a 3%.

Is it better to pay weekly or monthly credit card? Leia aqui Is it

It’s basically just digital use of the card without it. For example, venmo will charge you 3% fee. Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee. Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. The.

The App Will Charge You A % Fee If You Use A Credit Card Instead Of A Debit Card Or Bank.

In this case, a 3% fee applies, which is paid by the sender. It’s basically just digital use of the card without it. Apple is coding it as a cash advance rather than a purchase as paypal does. For example, venmo will charge you 3% fee.

I Suggest That You Contact Your Credit Card Issuer.

Another user has previously reported, for example, that bank of america treated their apple pay cash payment as a cash advance and charged them. As the sender, you use a credit card to fund an apple pay cash transfer. Using your card with apple pay won’t trigger any kind of cash advance or cash advance fee.