Is Airbnb Income Reported On Sche

Is Airbnb Income Reported On Sche - When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c.

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c.

App Economy Insights on Twitter "ABNB Airbnb's Statement."

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Tax on Airbnb All You Need To Know

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

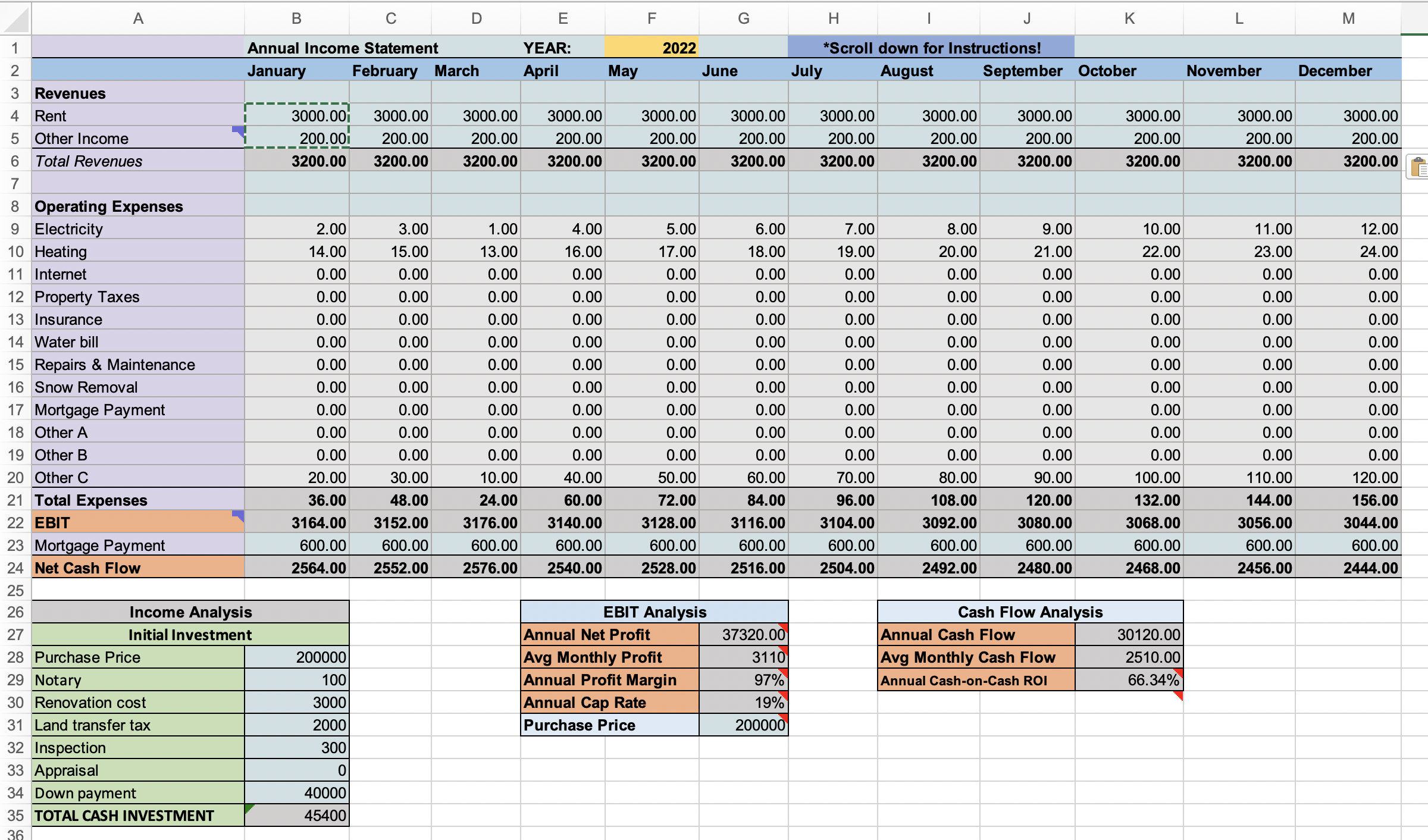

Airbnb Rental & Expense Spreadsheet Freelancer

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Brian Page Guide to Increasing Airbnb

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

How is Airbnb treated in the UK? Taxes & tax relief

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Airbnb Estimate How one can Calculate Partner for Finance

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c.

Airbnb and Rental Statement Tracker Rental Property and

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Airbnb Rental Statement Tracker With Expense Bookkeeping Cap

When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c. Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules

Airbnb Rental Expense Log and Statement google Sheets Etsy in

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c.

Vincere Tax Airbnb and IRS Classification Business or Rental?

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules When it comes to reporting your airbnb income on your tax return, you may be wondering whether you should use schedule c.

When It Comes To Reporting Your Airbnb Income On Your Tax Return, You May Be Wondering Whether You Should Use Schedule C.

Discover how to report your airbnb income on schedule c or e, with tips on services, rental type, and irs compliance rules