Is Tenant Improvement Be A Category For Quickbooks Online

Is Tenant Improvement Be A Category For Quickbooks Online - You must capitalize any expense you pay to improve your rental property. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it.

An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.

Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property.

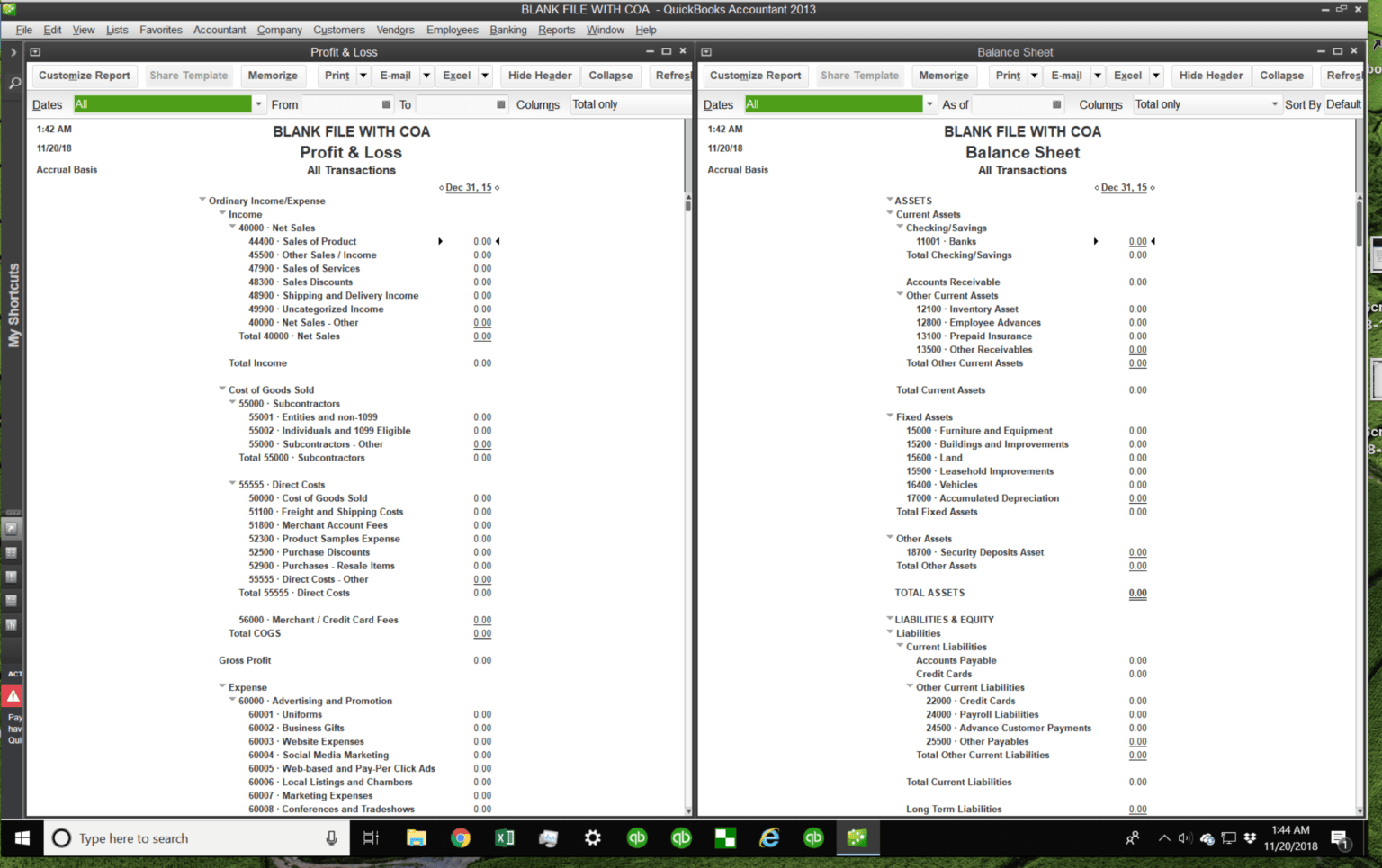

Real Estate Agent Chart Of Accounts

You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.

Lease Accounting Tenant Improvement Allowance Occupier

Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it.

Tenant Improvement Critique List

You must capitalize any expense you pay to improve your rental property. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it.

TENANT IMPROVEMENT PROJECT OFFICE Behance

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property.

McCarthy Building Companies Tenant Improvement CDs by SCA Design

An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Tips for Maximizing Your Tenant Improvement Budget Cook Builders

Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.

Fillable Online Construction of Tenant Improvement Plans Fax Email

Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income.

Project Gallery TSG Constructors

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these. An expense is for an improvement if it. You must capitalize any expense you pay to improve your rental property.

Tips for Maximizing Your Tenant Improvement Budget Cook Builders

You must capitalize any expense you pay to improve your rental property. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Calculating Tenant Improvement Allowance

All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property. An expense is for an improvement if it. Recording building improvements in quickbooks involves several key steps to ensure proper documentation and classification of these.

Recording Building Improvements In Quickbooks Involves Several Key Steps To Ensure Proper Documentation And Classification Of These.

An expense is for an improvement if it. All property improvements will be entered in the assets/depreciation section of the program under the rental & royalty income. You must capitalize any expense you pay to improve your rental property.