Notional Volume

Notional Volume - Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. How does notional value work? Notional value is the total asset value of a hedged position. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,.

Notional value is the total asset value of a hedged position. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. How does notional value work? Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts.

How does notional value work? Notional value is the total asset value of a hedged position. Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts.

Notional Cartesian control volume over a surface patch. (a) Homogeneous

Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Consider an interest rate swap,. How does notional value work?

100 Cash Rebates AlphaTick

How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position.

The Monthly Brief June 2023 Monthly Newsletter Paradigm

Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work? Notional value is the total asset value of a hedged position. Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade.

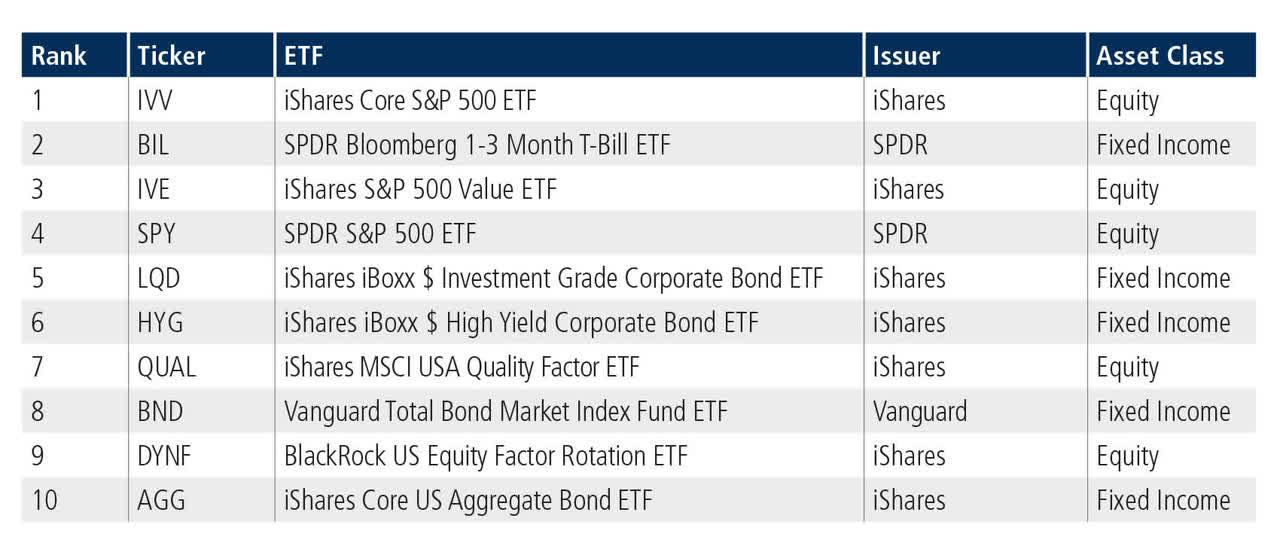

Tradeweb ExchangeTraded Funds Update January 2024 Seeking Alpha

Consider an interest rate swap,. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. How does notional value work?

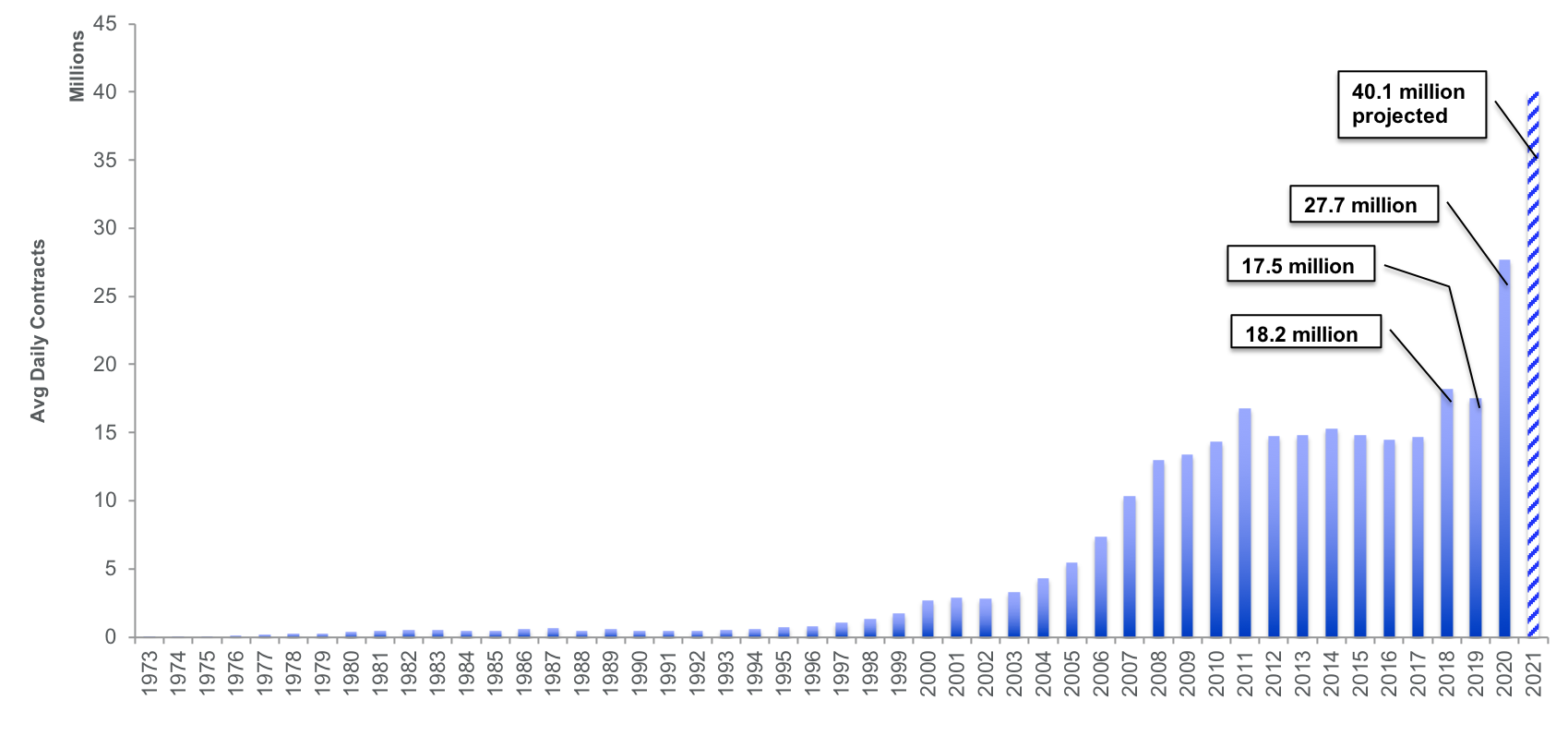

Data Insights 20210407 Q1 2021 Options Review

How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. Consider an interest rate swap,.

Traded 1 Dollar Notional Volume Credential Galxe

Notional value is the total asset value of a hedged position. How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,.

Notional Value Explained Options Trading Concepts YouTube

Consider an interest rate swap,. How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position.

What is Notional Value?

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Notional value is the total asset value of a hedged position. Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. How does notional value work?

Introducing Notional V3

Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. How does notional value work? Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Consider an interest rate swap,. Notional value is the total asset value of a hedged position.

What is Notional Volume and Why Does It Matter Go Hack Trading

Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts. Notional value is the total asset value of a hedged position. Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. How does notional value work?

Notional Value Is The Total Asset Value Of A Hedged Position.

How does notional value work? Using notional volume helps traders distinguish the total value of a trade from the market value when considering a trade. Consider an interest rate swap,. Notional volume represents the total theoretical value traded over a certain period, exceeding mere transaction counts.