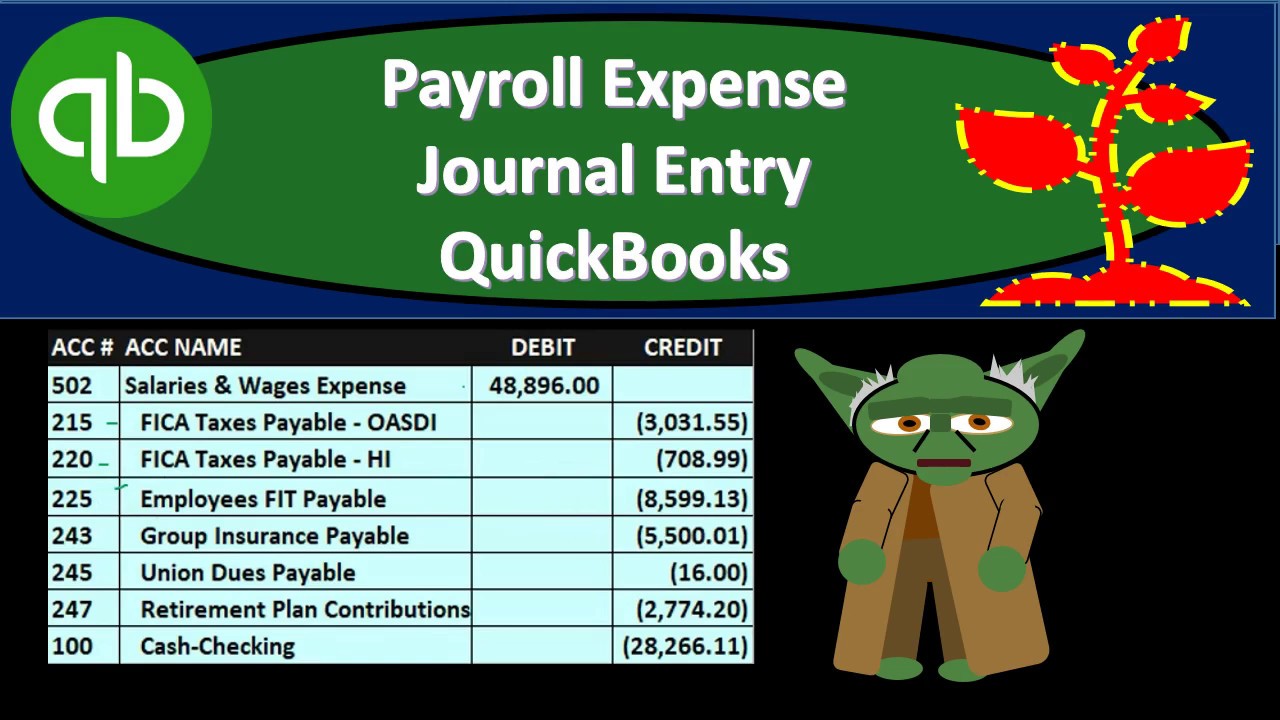

Payroll Journal Entry Quickbooks

Payroll Journal Entry Quickbooks - Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries. In this article, we’ll explore how to. Fill out the fields to create your journal entry.

In this article, we’ll explore how to. Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries.

Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. In this article, we’ll explore how to. Go to the company menu and select make general journal entries.

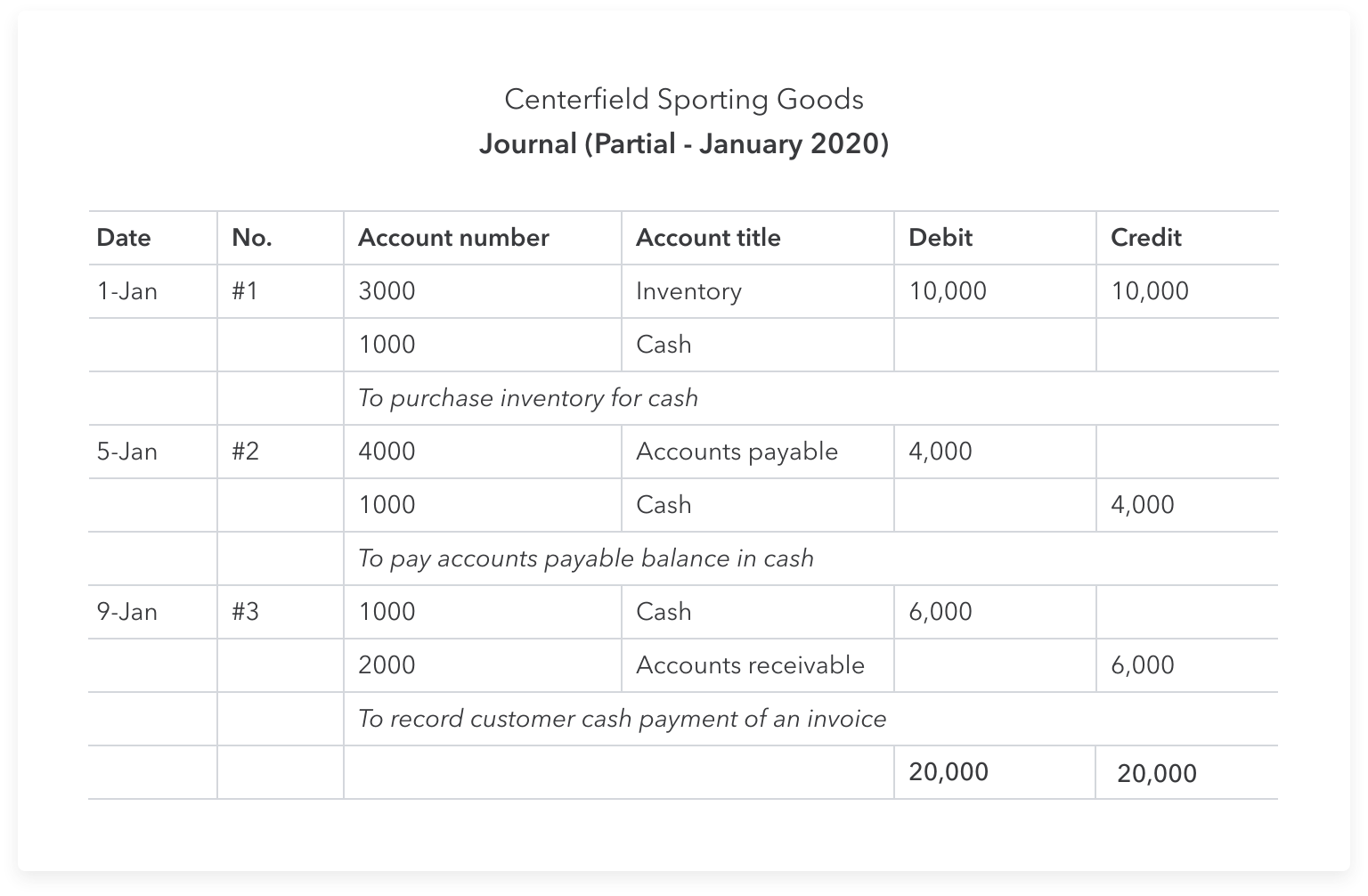

Payroll Journal Entry Template Excel

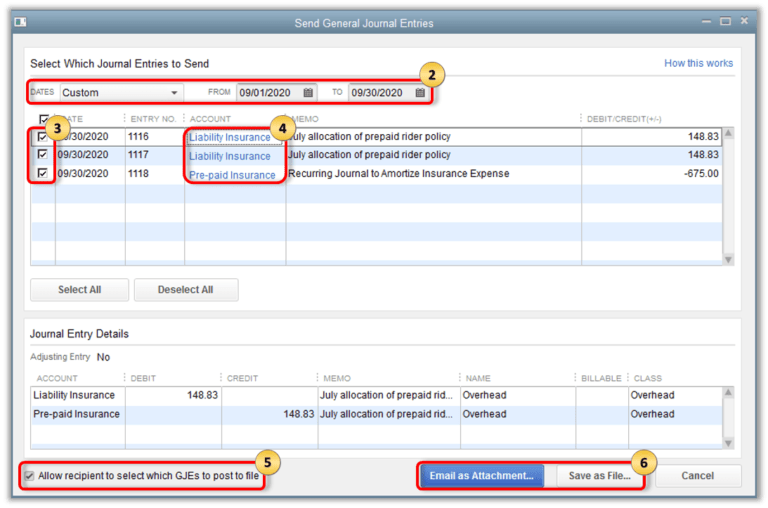

Go to the company menu and select make general journal entries. In this article, we’ll explore how to. Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations.

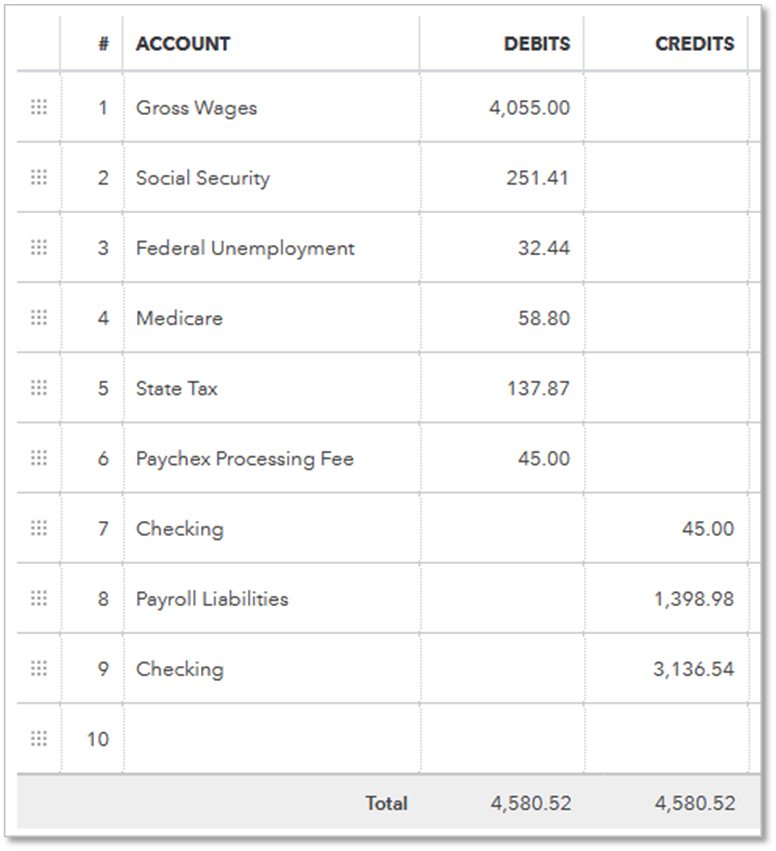

How should I enter the previous ADP Payroll into Quickbooks?

Fill out the fields to create your journal entry. Go to the company menu and select make general journal entries. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations.

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

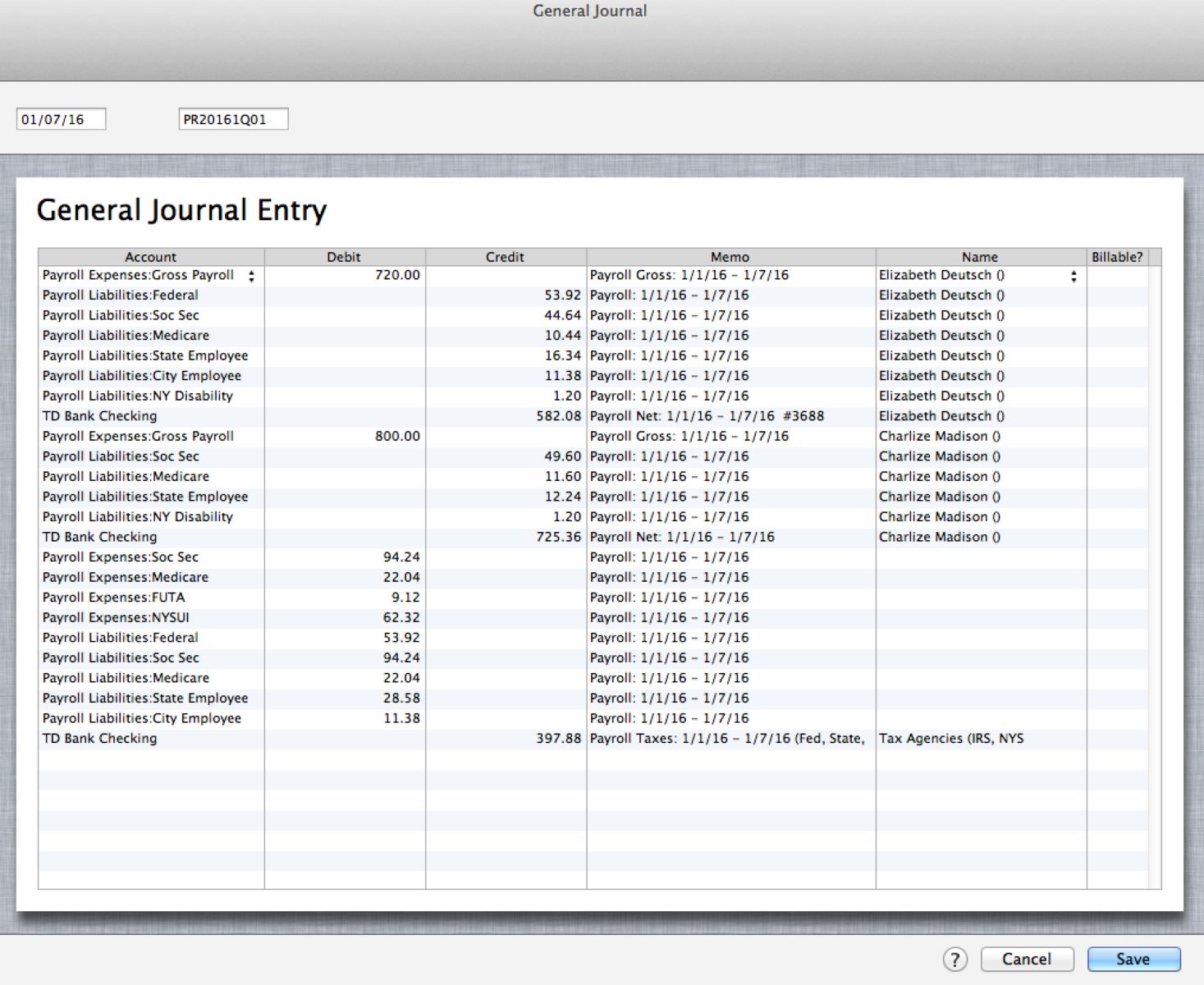

In this article, we’ll explore how to. Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise.

How to Make a Journal Entry in QuickBooks Online? QAsolved

In this article, we’ll explore how to. Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise.

Wave Payroll All about the bookkeeping Help Center

Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Go to the company menu and select make general journal entries.

How To Enter Journal Entry In Quickbooks Online

Fill out the fields to create your journal entry. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. In this article, we’ll explore how to. Go to the company menu and select make general journal entries. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise.

Record payroll transactions manually QuickBooks Community

Go to the company menu and select make general journal entries. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to.

Quickbooks Journal Entry Template

Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries.

Monthly Payroll Remittance Calculator Ape Salary

Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations. Go to the company menu and select make general journal entries.

Barbara Johnson Blog How to Record a QuickBooks Journal Entry

Go to the company menu and select make general journal entries. Fill out the fields to create your journal entry. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise. In this article, we’ll explore how to. Payroll journal entries are essential for accurate financial reporting and compliance with tax regulations.

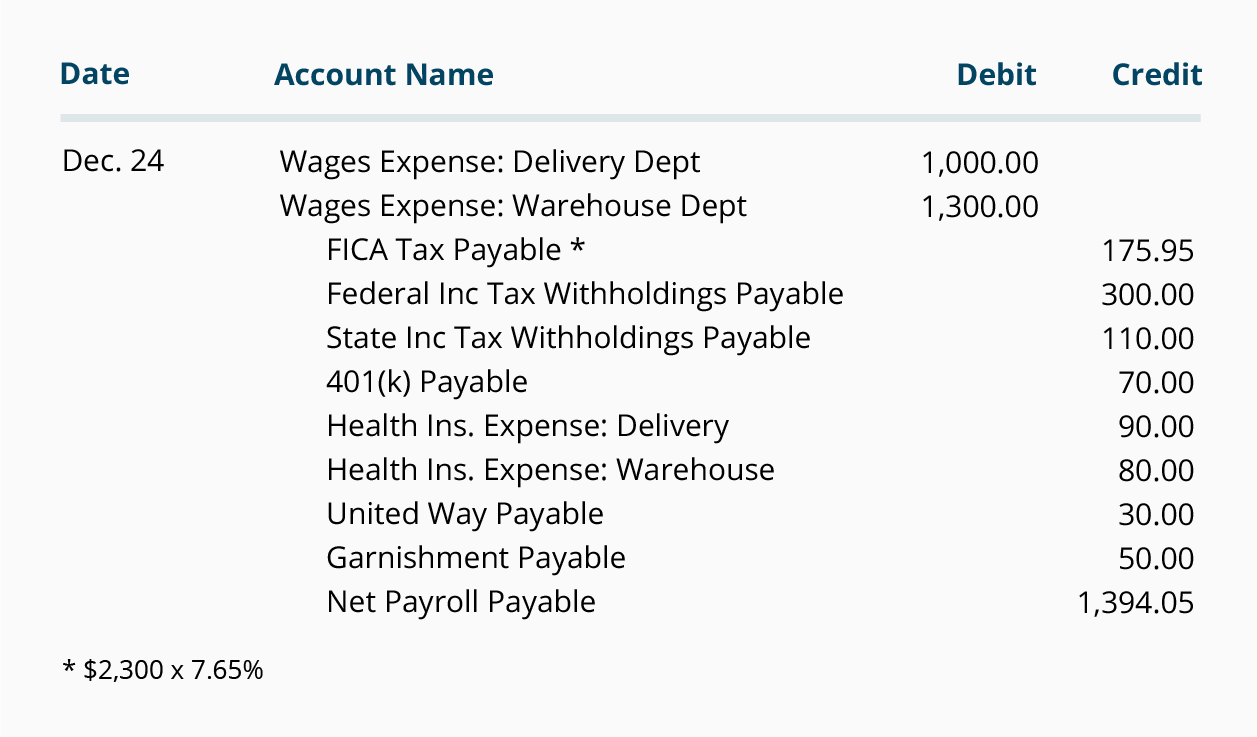

Payroll Journal Entries Are Essential For Accurate Financial Reporting And Compliance With Tax Regulations.

Fill out the fields to create your journal entry. Go to the company menu and select make general journal entries. In this article, we’ll explore how to. Creating a payroll journal entry in quickbooks allows for the accurate and systematic recording of payroll transactions, ensuring precise.