Quickbook Payments Fees

Quickbook Payments Fees - Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Quickbooks payments charges a fee each time you process a transaction. This fee varies depending on how the transaction is. Please refer to these rates: Fees will be determined depending on how you process the payments. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks.

If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. This fee varies depending on how the transaction is. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Quickbooks payments charges a fee each time you process a transaction. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Please refer to these rates: Fees will be determined depending on how you process the payments. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a.

Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Fees will be determined depending on how you process the payments. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Please refer to these rates: The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments charges a fee each time you process a transaction. This fee varies depending on how the transaction is. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a.

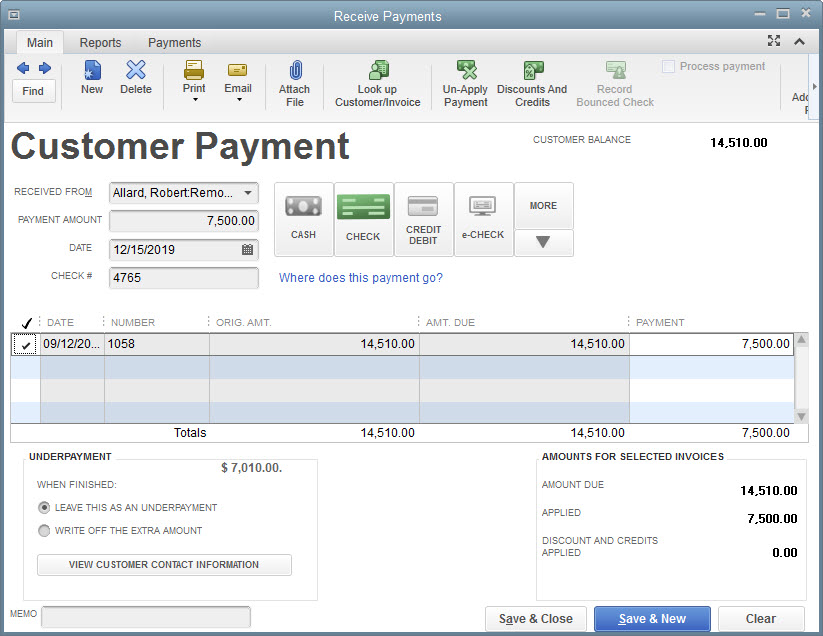

How to enter Credit Card Charges Reconcile and apply Partial Payments

Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. This fee varies depending on how the transaction is. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Quickbooks payments charges a fee each time you process a transaction. If you process more than $2,500 in payments each month, you.

Mesh Payments Announces Expanded QuickBook Integration to Give

This fee varies depending on how the transaction is. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Fees will be determined depending on how you process the payments. Please refer to these rates: Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's.

QuickBooks Payments 2019 Review ZipBooks

Please refer to these rates: Quickbooks payments charges a fee each time you process a transaction. This fee varies depending on how the transaction is. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. The fees vary, depending on your sales volume, the amount of your average credit card.

How to record a deposit with Credit Card fees in QB Online Accounting

Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Fees will be determined depending on how you process the payments. The fees vary, depending on your sales volume, the amount of your average credit card sales.

Set Up Scheduled Recurring Payments In QuickBooks Online PART 2

Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Fees will be determined depending on how you process the payments. This fee varies depending on how the transaction is. Quickbooks payments charges a fee each.

Automate Paying Payroll Taxes in QuickBooks Experts in QuickBooks

Please refer to these rates: Fees will be determined depending on how you process the payments. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. Learn about payment processing fees.if you use quickbooks payments to.

How to Receive payments in QuickBook Online and deposit into Bank

Fees will be determined depending on how you process the payments. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Please refer to these rates: If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. The fees vary, depending on your sales volume,.

How to use QuickBooks Payments to receive payments from customers YouTube

This fee varies depending on how the transaction is. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. If you process more than $2,500 in payments each month, you could save money on fees by.

Mesh Payments Announces Expanded QuickBook Integration to Give

Quickbooks payments charges a fee each time you process a transaction. Please refer to these rates: The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time. Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Quickbooks payments seamlessly integrates with quickbooks and.

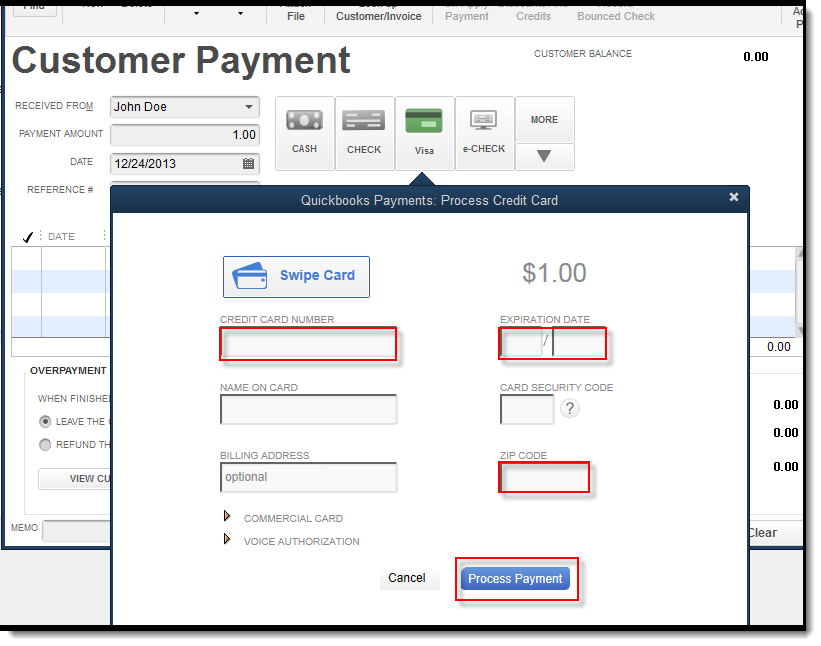

Process a credit card payment in QuickBooks Desktop QuickBooks Learn

Fees will be determined depending on how you process the payments. If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Please refer to these rates: Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach. The fees vary, depending on your sales volume, the amount of.

This Fee Varies Depending On How The Transaction Is.

Learn about payment processing fees.if you use quickbooks payments to take payments from quickbooks, there's a. Please refer to these rates: Fees will be determined depending on how you process the payments. The fees vary, depending on your sales volume, the amount of your average credit card sales transaction, and the funding time.

Quickbooks Payments Charges A Fee Each Time You Process A Transaction.

If you process more than $2,500 in payments each month, you could save money on fees by switching to quickbooks. Quickbooks payments seamlessly integrates with quickbooks and includes ecommerce support, invoicing, and ach.