Quickbooks Beginning Balance

Quickbooks Beginning Balance - Quickbooks gets an account's beginning balance from one of two places: Each time you start reconciling an account, you review the beginning balance in quickbooks. It's the amount in the account at. Pick an easy date to start your opening balance. If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. If you just opened a new account at your bank, use the day you opened the. For new accounts (or ones that have never been reconciled), quickbooks.

It's the amount in the account at. Each time you start reconciling an account, you review the beginning balance in quickbooks. Pick an easy date to start your opening balance. If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. If you just opened a new account at your bank, use the day you opened the. Quickbooks gets an account's beginning balance from one of two places: For new accounts (or ones that have never been reconciled), quickbooks.

If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. Quickbooks gets an account's beginning balance from one of two places: If you just opened a new account at your bank, use the day you opened the. Pick an easy date to start your opening balance. It's the amount in the account at. Each time you start reconciling an account, you review the beginning balance in quickbooks. For new accounts (or ones that have never been reconciled), quickbooks.

Quickbooks Beginning Balance Instructions PDF Debits And Credits

If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. Each time you start reconciling an account, you review the beginning balance in quickbooks. If you just opened a new account at your bank, use the day you opened the. Pick an easy date to start your opening balance. It's.

How to Change the Beginning Balance in QuickBooks Online

If you just opened a new account at your bank, use the day you opened the. Quickbooks gets an account's beginning balance from one of two places: For new accounts (or ones that have never been reconciled), quickbooks. Each time you start reconciling an account, you review the beginning balance in quickbooks. It's the amount in the account at.

How to fix beginning balance issues when reconciling in QuickBooks

Pick an easy date to start your opening balance. It's the amount in the account at. For new accounts (or ones that have never been reconciled), quickbooks. If you just opened a new account at your bank, use the day you opened the. Quickbooks gets an account's beginning balance from one of two places:

How To Change Beginning Balance In Quickbooks Online Reconciliation

Quickbooks gets an account's beginning balance from one of two places: It's the amount in the account at. Pick an easy date to start your opening balance. Each time you start reconciling an account, you review the beginning balance in quickbooks. If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance.

How to Change the Beginning Balance in QuickBooks Online

Pick an easy date to start your opening balance. Quickbooks gets an account's beginning balance from one of two places: Each time you start reconciling an account, you review the beginning balance in quickbooks. If you just opened a new account at your bank, use the day you opened the. For new accounts (or ones that have never been reconciled),.

How to Fix Beginning Balance Issues in QuickBooks Online YouTube

If you just opened a new account at your bank, use the day you opened the. Each time you start reconciling an account, you review the beginning balance in quickbooks. It's the amount in the account at. Pick an easy date to start your opening balance. Quickbooks gets an account's beginning balance from one of two places:

How to Change the Beginning Balance in QuickBooks Desktop & Online?

Pick an easy date to start your opening balance. Quickbooks gets an account's beginning balance from one of two places: If you just opened a new account at your bank, use the day you opened the. It's the amount in the account at. For new accounts (or ones that have never been reconciled), quickbooks.

QuickBooks Reconcile Change Beginning Balance

Each time you start reconciling an account, you review the beginning balance in quickbooks. Quickbooks gets an account's beginning balance from one of two places: Pick an easy date to start your opening balance. If you just opened a new account at your bank, use the day you opened the. If the beginning balance on your statement doesn't match what.

QuickBooks Reconcile Change Beginning Balance Reconcile Books

For new accounts (or ones that have never been reconciled), quickbooks. Quickbooks gets an account's beginning balance from one of two places: If you just opened a new account at your bank, use the day you opened the. If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. Each time.

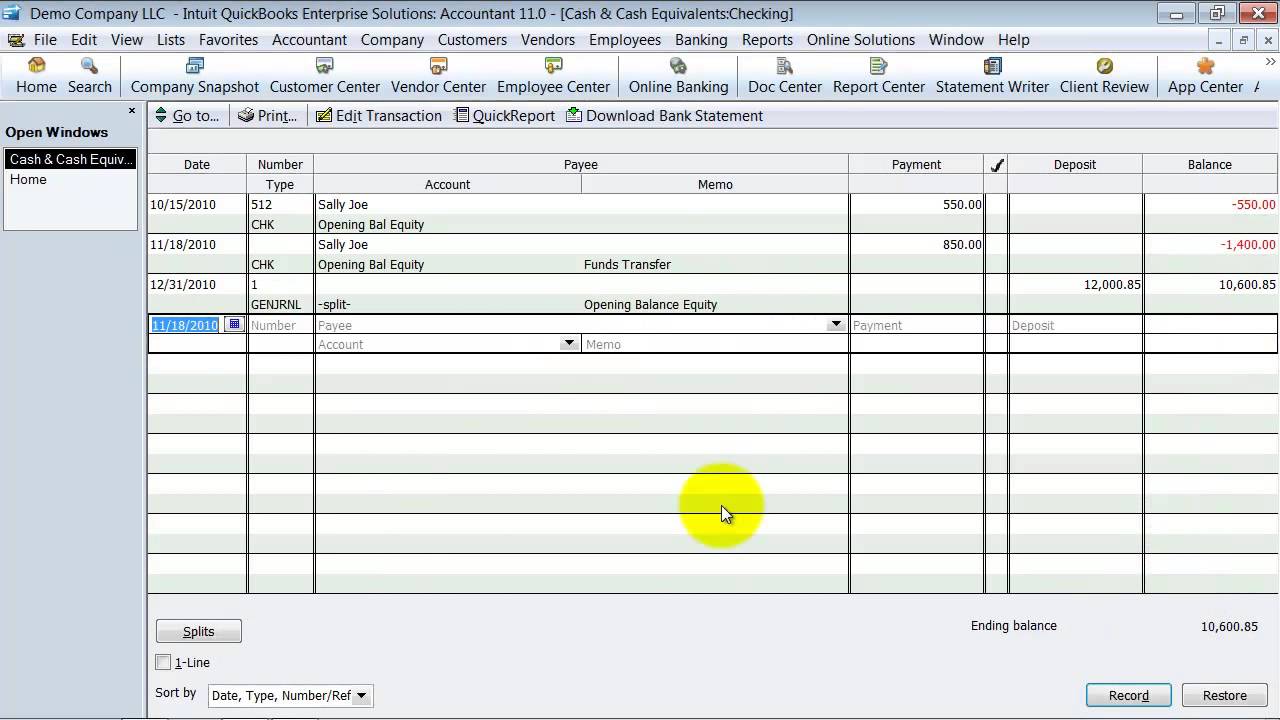

QuickBooks Training Enter Beginning Balances YouTube

It's the amount in the account at. Each time you start reconciling an account, you review the beginning balance in quickbooks. Quickbooks gets an account's beginning balance from one of two places: If you just opened a new account at your bank, use the day you opened the. For new accounts (or ones that have never been reconciled), quickbooks.

Quickbooks Gets An Account's Beginning Balance From One Of Two Places:

If the beginning balance on your statement doesn't match what you have in quickbooks, it's called a beginning balance discrepancy. If you just opened a new account at your bank, use the day you opened the. For new accounts (or ones that have never been reconciled), quickbooks. Each time you start reconciling an account, you review the beginning balance in quickbooks.

Pick An Easy Date To Start Your Opening Balance.

It's the amount in the account at.