Quickbooks Cancel Payroll

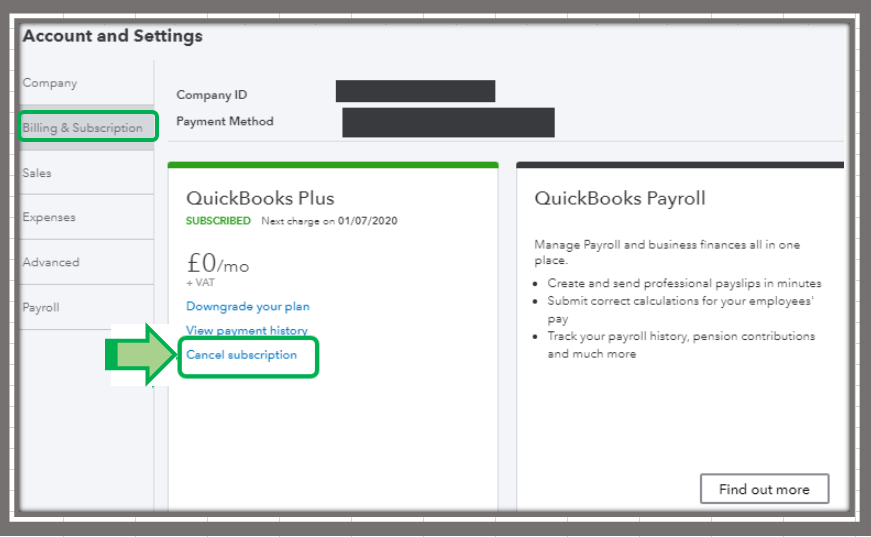

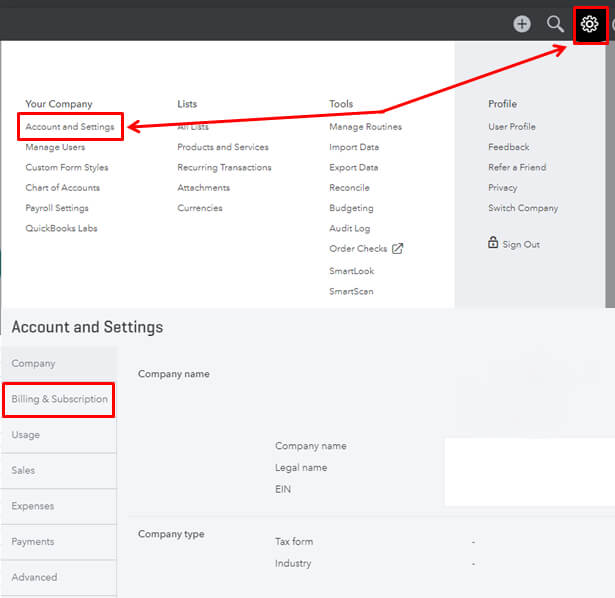

Quickbooks Cancel Payroll - Answer some questions to let us. Next you will have to log into your company file and follow these steps: Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. From the billing & subscription tab, click cancel next to your subscription status. In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. To cancel (turn off) your payroll subscription: The best way to cancel your payroll service is directly in your quickbooks desktop company file.

The best way to cancel your payroll service is directly in your quickbooks desktop company file. In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. To cancel (turn off) your payroll subscription: Answer some questions to let us. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. Next you will have to log into your company file and follow these steps: From the billing & subscription tab, click cancel next to your subscription status.

The best way to cancel your payroll service is directly in your quickbooks desktop company file. In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. Answer some questions to let us. From the billing & subscription tab, click cancel next to your subscription status. To cancel (turn off) your payroll subscription: Next you will have to log into your company file and follow these steps: Click on the gear > your account on the billing info tab (to the right) > edit billing info under the.

How To Cancel Payroll In Quickbooks

Answer some questions to let us. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. From the billing & subscription tab, click cancel next to your subscription status. To cancel (turn off) your payroll subscription: In this comprehensive guide, we will walk you through the steps to cancel,.

QuickBooks Payroll Subscription An Ultimate Guide To Do Scott M

In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. The best way to cancel your payroll service is directly in your quickbooks desktop company file. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. Next you will.

How To Cancel Payroll In Quickbooks

Next you will have to log into your company file and follow these steps: Answer some questions to let us. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. From the billing & subscription tab, click cancel next to your subscription status. To cancel (turn off) your payroll.

Why Is Quickbooks Online So Slow

Next you will have to log into your company file and follow these steps: From the billing & subscription tab, click cancel next to your subscription status. In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. Answer some questions to let us. To cancel (turn off) your payroll subscription:

How To Setup Quickbooks Payroll

Answer some questions to let us. Next you will have to log into your company file and follow these steps: The best way to cancel your payroll service is directly in your quickbooks desktop company file. From the billing & subscription tab, click cancel next to your subscription status. To cancel (turn off) your payroll subscription:

Ways To cancel direct deposit in QuickBooks Payroll

To cancel (turn off) your payroll subscription: The best way to cancel your payroll service is directly in your quickbooks desktop company file. From the billing & subscription tab, click cancel next to your subscription status. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. In this comprehensive.

How to Cancel QuickBooks Online Subscription (Unsubscribe)

Answer some questions to let us. From the billing & subscription tab, click cancel next to your subscription status. Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. To cancel (turn off) your payroll subscription: Next you will have to log into your company file and follow these.

PPT How to cancel direct deposit in QuickBooks Payroll PowerPoint

The best way to cancel your payroll service is directly in your quickbooks desktop company file. Next you will have to log into your company file and follow these steps: In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. To cancel (turn off) your payroll subscription: From the billing.

How to Cancel QuickBooks Subscription

In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. Next you will have to log into your company file and follow these steps: Click on the gear > your account on the billing info tab (to the right) > edit billing info under the. The best way to cancel.

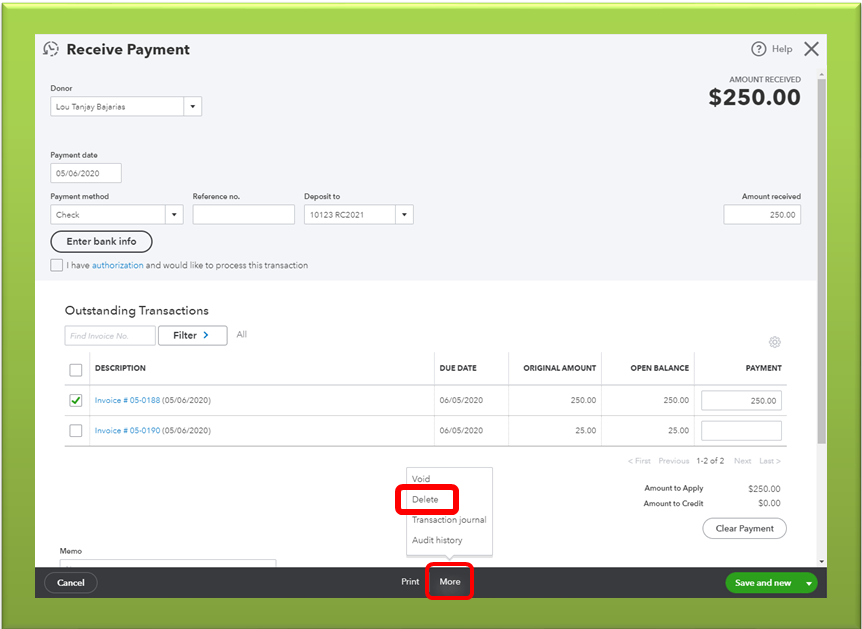

how to delete multiple deposits in quickbooks desktop Ctrlr

The best way to cancel your payroll service is directly in your quickbooks desktop company file. In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. Answer some questions to let us. From the billing & subscription tab, click cancel next to your subscription status. To cancel (turn off) your.

Click On The Gear > Your Account On The Billing Info Tab (To The Right) > Edit Billing Info Under The.

In this comprehensive guide, we will walk you through the steps to cancel, delete, or turn off payroll in quickbooks. The best way to cancel your payroll service is directly in your quickbooks desktop company file. Next you will have to log into your company file and follow these steps: From the billing & subscription tab, click cancel next to your subscription status.

To Cancel (Turn Off) Your Payroll Subscription:

Answer some questions to let us.