Quickbooks Owners Draw

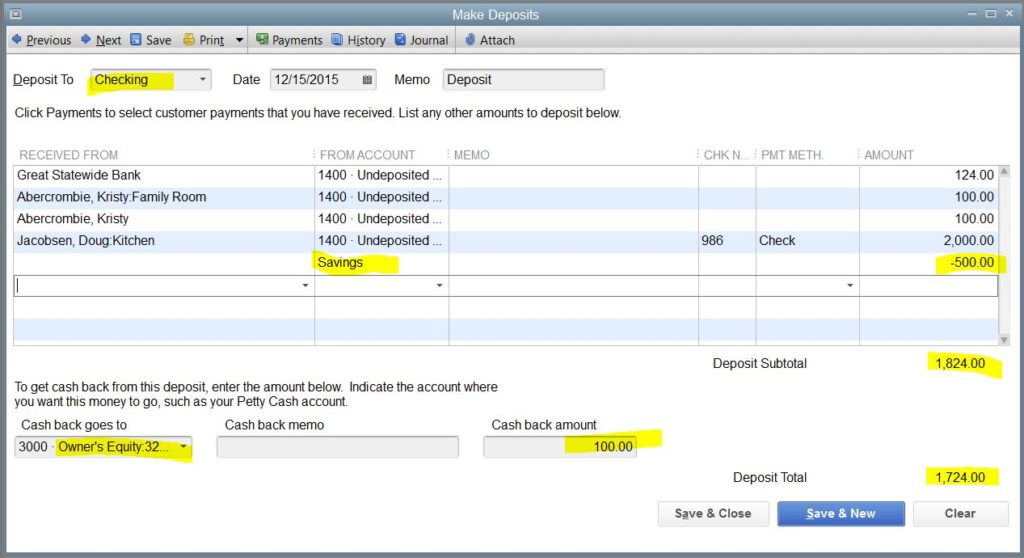

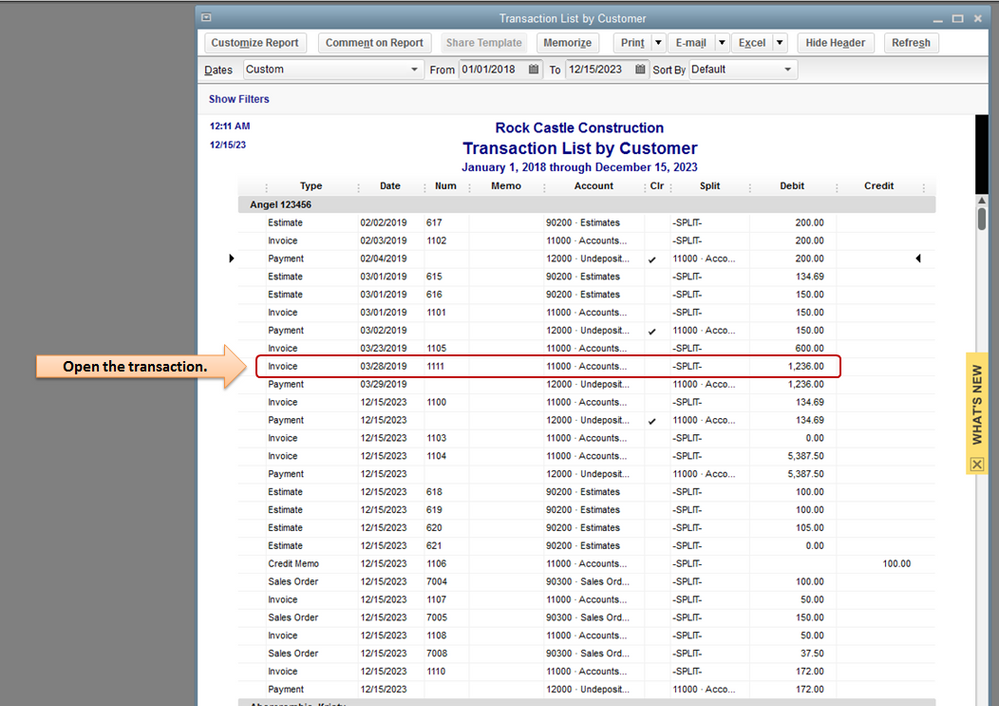

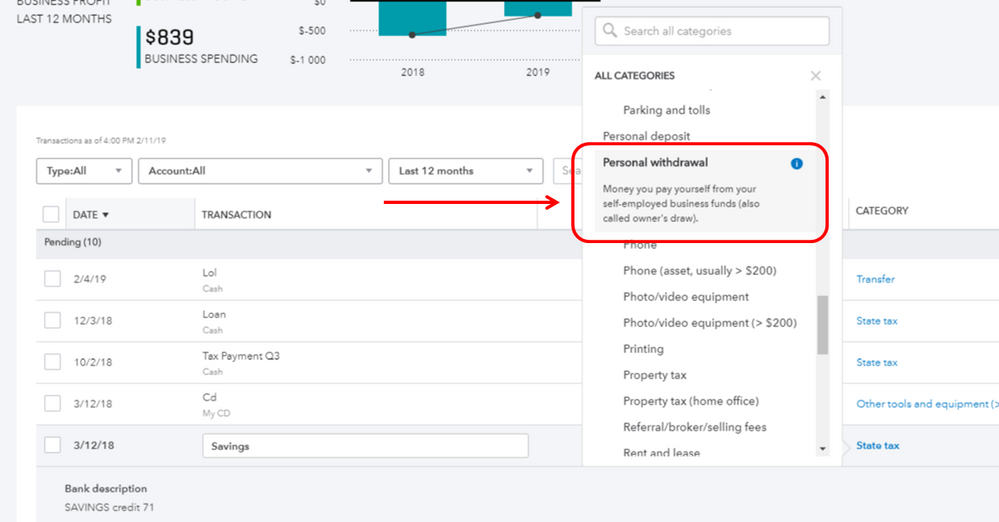

Quickbooks Owners Draw - Depending on your business type, you may be able to pay yourself using an owner's draw or salary. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. If you're a sole proprietor, you must be paid with an. Learn how to pay an owner of a sole proprietor business in quickbooks online. To help you decide what’s best. To record an owner’s draw in quickbooks online (qbo), follow these steps: To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Go to the “banking” tab and select “make a.

To record an owner’s draw in quickbooks online (qbo), follow these steps: Depending on your business type, you may be able to pay yourself using an owner's draw or salary. Go to the “banking” tab and select “make a. If you're a sole proprietor, you must be paid with an. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Learn how to pay an owner of a sole proprietor business in quickbooks online. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. To help you decide what’s best.

To record an owner’s draw in quickbooks online (qbo), follow these steps: If you're a sole proprietor, you must be paid with an. Depending on your business type, you may be able to pay yourself using an owner's draw or salary. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. To help you decide what’s best. Learn how to pay an owner of a sole proprietor business in quickbooks online. Go to the “banking” tab and select “make a. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank.

how to take an owner's draw in quickbooks Masako Arndt

To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Learn how to pay an owner of a sole proprietor business in quickbooks online. If you're a sole proprietor, you must be paid with an. Depending on your business type, you may be able to pay yourself using.

how to take an owner's draw in quickbooks Masako Arndt

Learn how to pay an owner of a sole proprietor business in quickbooks online. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. Depending on your business type,.

Owners Draw Quickbooks Desktop Warehouse of Ideas

To help you decide what’s best. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. If you're a sole proprietor, you must be paid with an. To record.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Learn how to pay an owner of a sole proprietor business in quickbooks online. Go to the “banking” tab and select “make a. To help you decide what’s best. If you're a sole proprietor, you must be paid with an. To record an owner’s draw in quickbooks online (qbo), follow these steps:

Owners Draw Quickbooks Desktop DRAWING IDEAS

Go to the “banking” tab and select “make a. Depending on your business type, you may be able to pay yourself using an owner's draw or salary. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. To record an owner’s draw in quickbooks online (qbo), follow these.

Owners Draw Quickbooks Desktop DRAWING IDEAS

Go to the “banking” tab and select “make a. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. Depending on your business type, you may be able to pay yourself using an owner's draw or salary. To record an owner’s draw in quickbooks online (qbo), follow these steps: To properly.

Owner Draw Report Quickbooks

Depending on your business type, you may be able to pay yourself using an owner's draw or salary. To record an owner’s draw in quickbooks online (qbo), follow these steps: To help you decide what’s best. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Learn how.

owners draw quickbooks desktop Renata Buss

To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. To help you decide what’s best. Go to the “banking” tab and select “make a. Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank. If you're a sole.

Owners Draw Quickbooks Desktop DRAWING IDEAS

Depending on your business type, you may be able to pay yourself using an owner's draw or salary. If you're a sole proprietor, you must be paid with an. Go to the “banking” tab and select “make a. Learn how to pay an owner of a sole proprietor business in quickbooks online. To properly record an owner’s draw in quickbooks,.

Owners Draw Report In Quickbooks Online Warehouse of Ideas

Depending on your business type, you may be able to pay yourself using an owner's draw or salary. Go to the “banking” tab and select “make a. To properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal. Learn how to pay an owner of a sole proprietor business.

Recording Draws In Quickbooks Requires Setting Up Owner Draw Accounts And Posting Monies Taken Out Of The Business Bank.

Learn how to pay an owner of a sole proprietor business in quickbooks online. To record an owner’s draw in quickbooks online (qbo), follow these steps: Depending on your business type, you may be able to pay yourself using an owner's draw or salary. Go to the “banking” tab and select “make a.

To Properly Record An Owner’s Draw In Quickbooks, It Is Essential To Create A Dedicated Owner’s Equity Account To Track The Withdrawal.

To help you decide what’s best. If you're a sole proprietor, you must be paid with an.