Quickbooks Schedule C

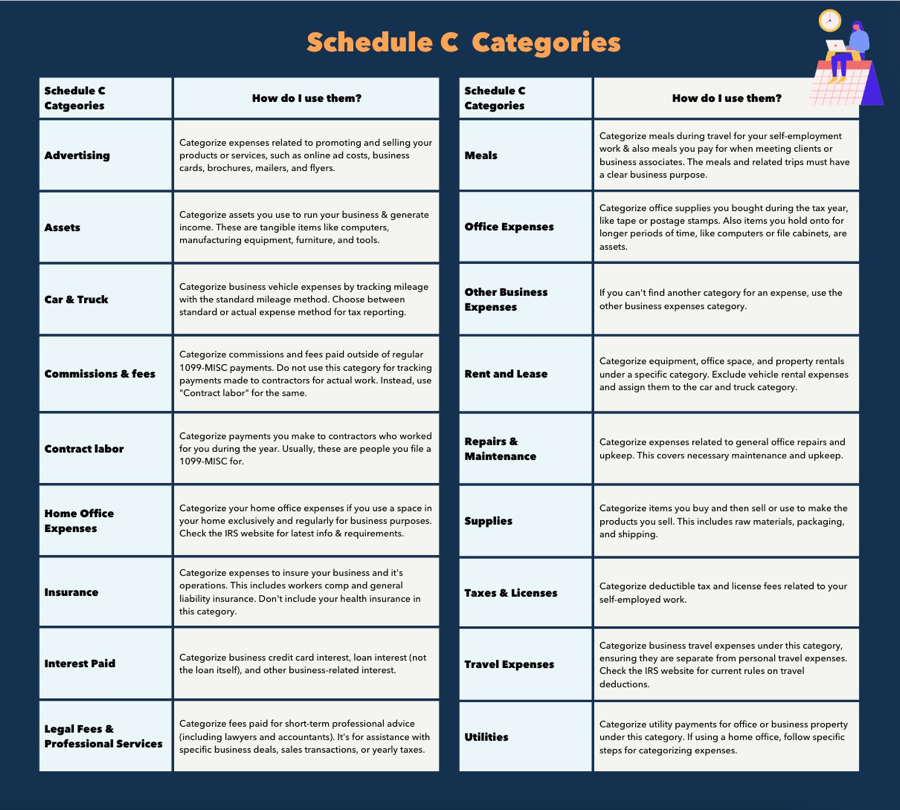

Quickbooks Schedule C - The schedule c form allows you to report the income you've generated or lost in your business to the irs. Learn how schedule c categories appear on reports. Run one of your financial reports to get details on transactions for each. Learn about schedule c categories and how to categorize transactions in quickbooks.

The schedule c form allows you to report the income you've generated or lost in your business to the irs. Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports. Run one of your financial reports to get details on transactions for each.

The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each. Learn how schedule c categories appear on reports. Learn about schedule c categories and how to categorize transactions in quickbooks.

QuickBooks Review 2023 A Comprehensive Guide to QuickBooks for

Learn about schedule c categories and how to categorize transactions in quickbooks. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each. Learn how schedule c categories appear on reports.

Comparison QuickBooks Vs. QuickBooks Enterprise Aenten US

Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each.

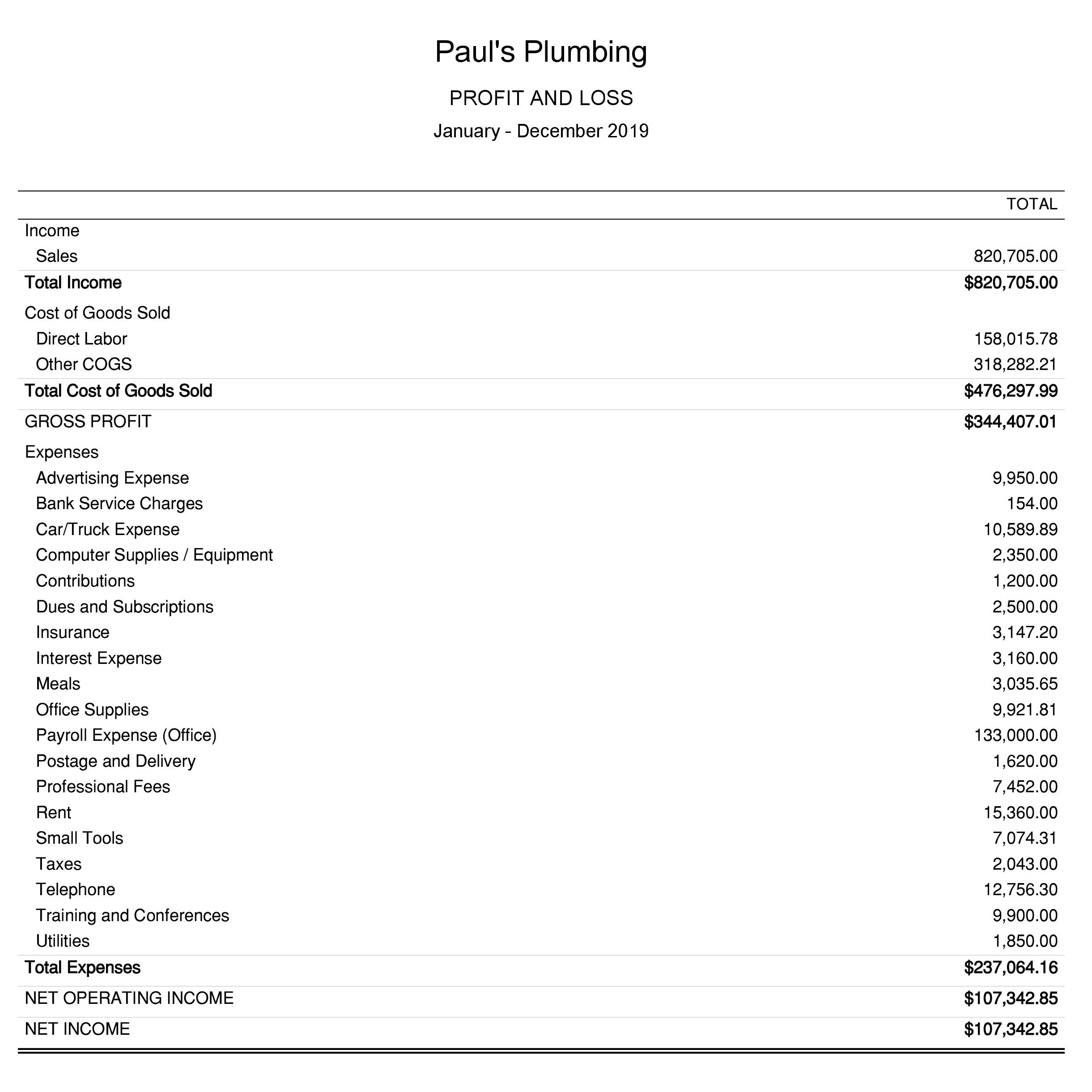

Profit And Loss Statement Template For Truck Drivers

The schedule c form allows you to report the income you've generated or lost in your business to the irs. Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports. Run one of your financial reports to get details on transactions for each.

Quickbooks 2015 With Serial Key Torrent

Learn how schedule c categories appear on reports. Run one of your financial reports to get details on transactions for each. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Learn about schedule c categories and how to categorize transactions in quickbooks.

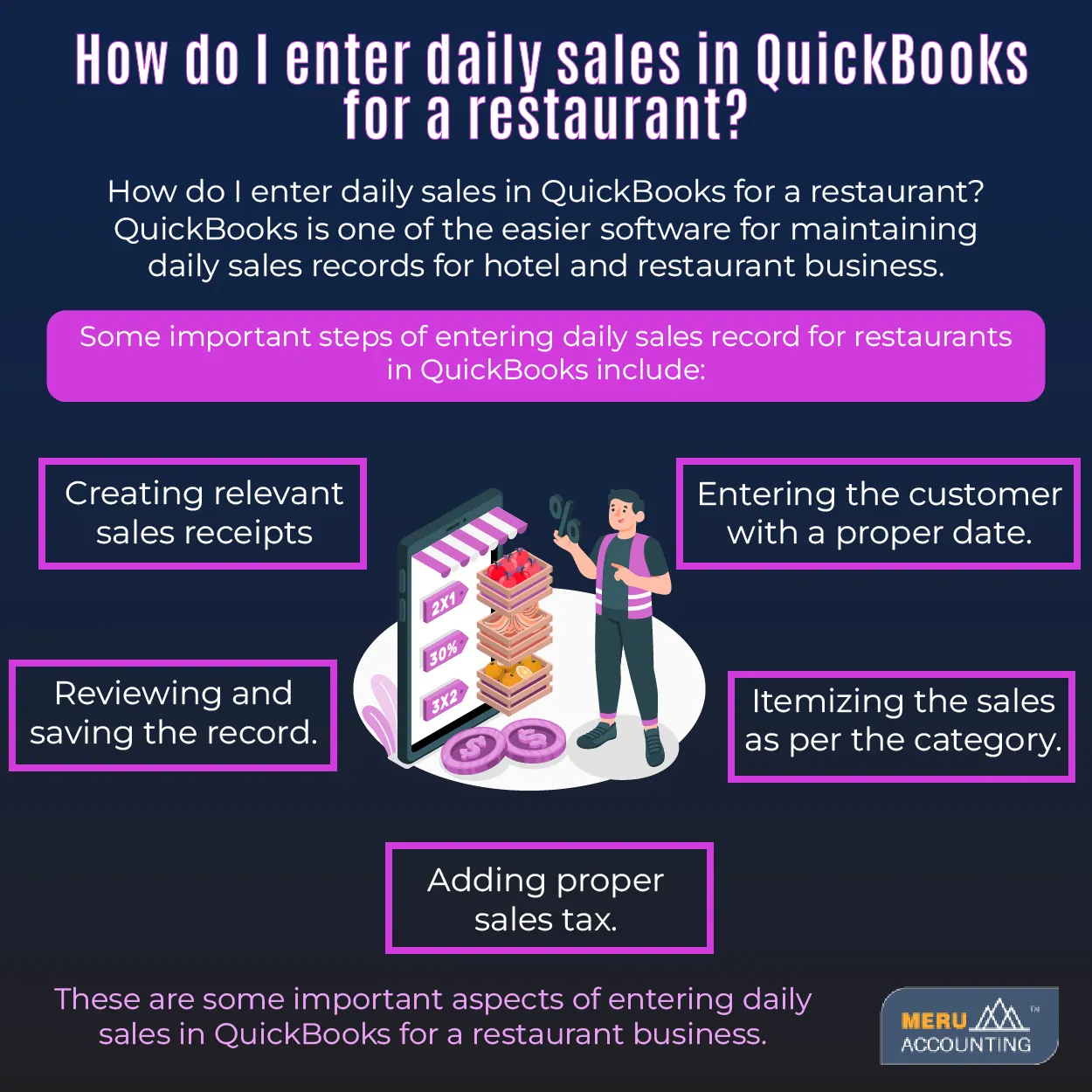

Accounts Junction How do I enter daily sales in QuickBooks for a

The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each. Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports.

From an Accountant’s Perspective Using QuickBooks SelfEmployed for

Run one of your financial reports to get details on transactions for each. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports.

QuickBooks Customers List QuickBooks Users Email List

Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports. Run one of your financial reports to get details on transactions for each. The schedule c form allows you to report the income you've generated or lost in your business to the irs.

QuickBooks Online Simple Start QuickBooks

The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each. Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports.

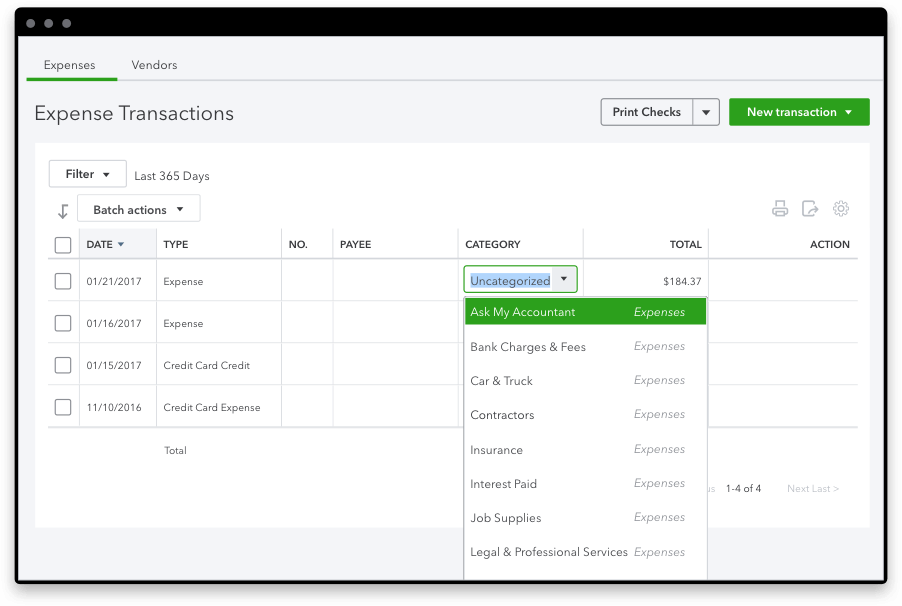

Schedule C and expense categories in QuickBooks Solopreneur and

Learn about schedule c categories and how to categorize transactions in quickbooks. Learn how schedule c categories appear on reports. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each.

QuickBooks FedNow Instant Payments Service

Learn about schedule c categories and how to categorize transactions in quickbooks. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each. Learn how schedule c categories appear on reports.

Learn How Schedule C Categories Appear On Reports.

Learn about schedule c categories and how to categorize transactions in quickbooks. The schedule c form allows you to report the income you've generated or lost in your business to the irs. Run one of your financial reports to get details on transactions for each.