Your Quickbooks Payments Taxpayer Info Is Invalid

Your Quickbooks Payments Taxpayer Info Is Invalid - Learn what to do if your taxpayer info is wrong. We'll create the form 1099 for you on or before january 31. Here's what to do if. Clear the direct debit information ; Quickbooks payments is available at an additional cost. If something goes wrong, we're here to help. You can pay instantly on the irs make a payment page.

You can pay instantly on the irs make a payment page. We'll create the form 1099 for you on or before january 31. Quickbooks payments is available at an additional cost. Learn what to do if your taxpayer info is wrong. Clear the direct debit information ; If something goes wrong, we're here to help. Here's what to do if.

Clear the direct debit information ; Quickbooks payments is available at an additional cost. If something goes wrong, we're here to help. Here's what to do if. You can pay instantly on the irs make a payment page. Learn what to do if your taxpayer info is wrong. We'll create the form 1099 for you on or before january 31.

Partial Payments Through QuickBooks ThoroVet Knowledge Base

If something goes wrong, we're here to help. Clear the direct debit information ; We'll create the form 1099 for you on or before january 31. You can pay instantly on the irs make a payment page. Quickbooks payments is available at an additional cost.

Best ERP Software for the Pharmaceutical Industry

Here's what to do if. If something goes wrong, we're here to help. We'll create the form 1099 for you on or before january 31. You can pay instantly on the irs make a payment page. Learn what to do if your taxpayer info is wrong.

QuickBooks Payments Users Email List Verified Users Database

If something goes wrong, we're here to help. Here's what to do if. We'll create the form 1099 for you on or before january 31. Quickbooks payments is available at an additional cost. Clear the direct debit information ;

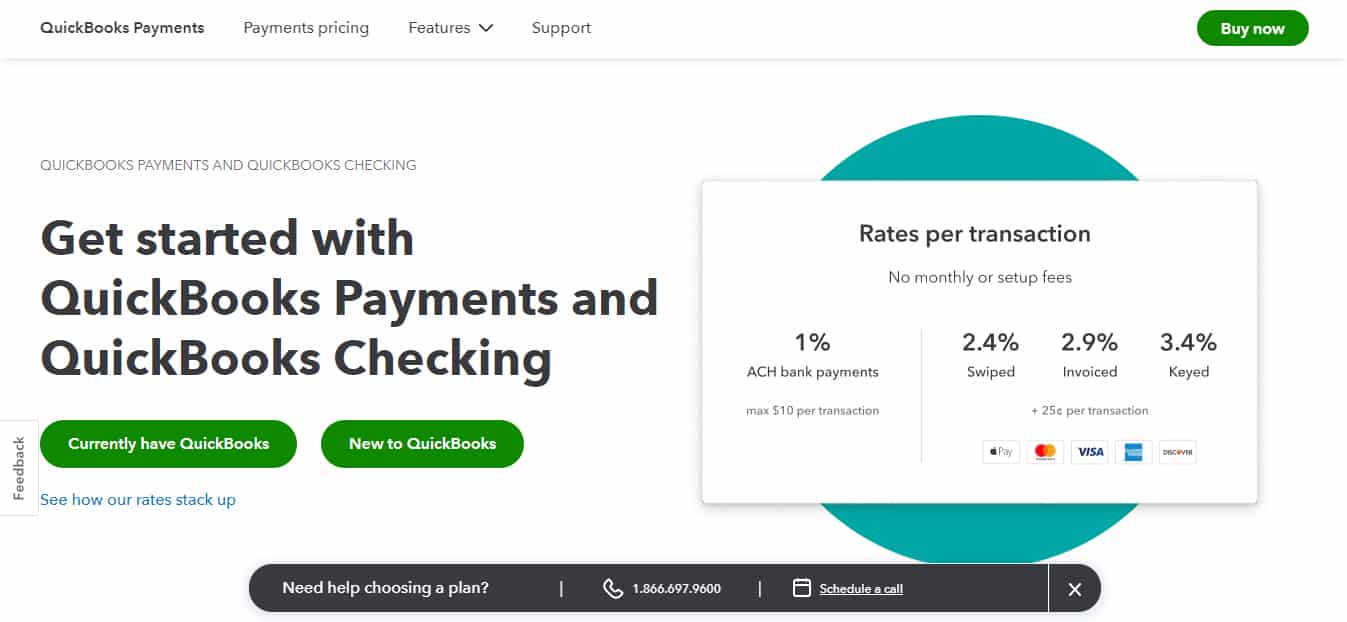

Are You Overpaying on Your Quickbooks Payments Fees?

You can pay instantly on the irs make a payment page. Clear the direct debit information ; Quickbooks payments is available at an additional cost. We'll create the form 1099 for you on or before january 31. If something goes wrong, we're here to help.

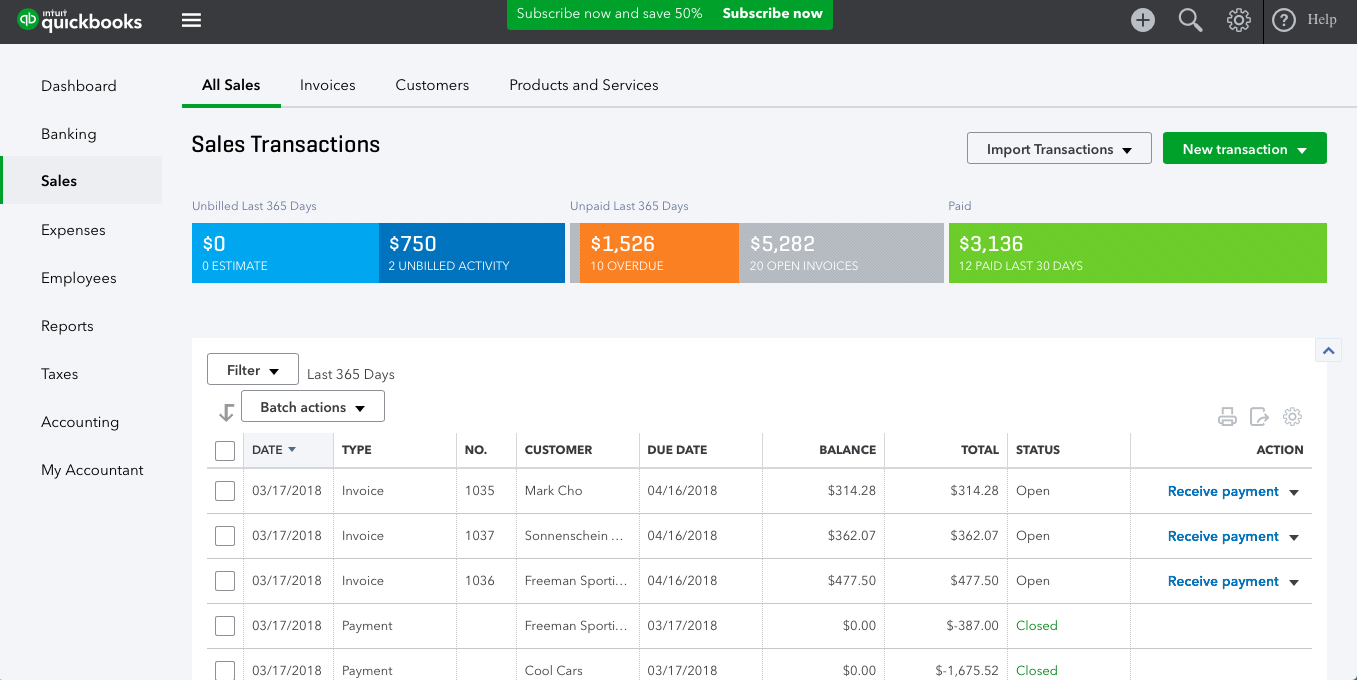

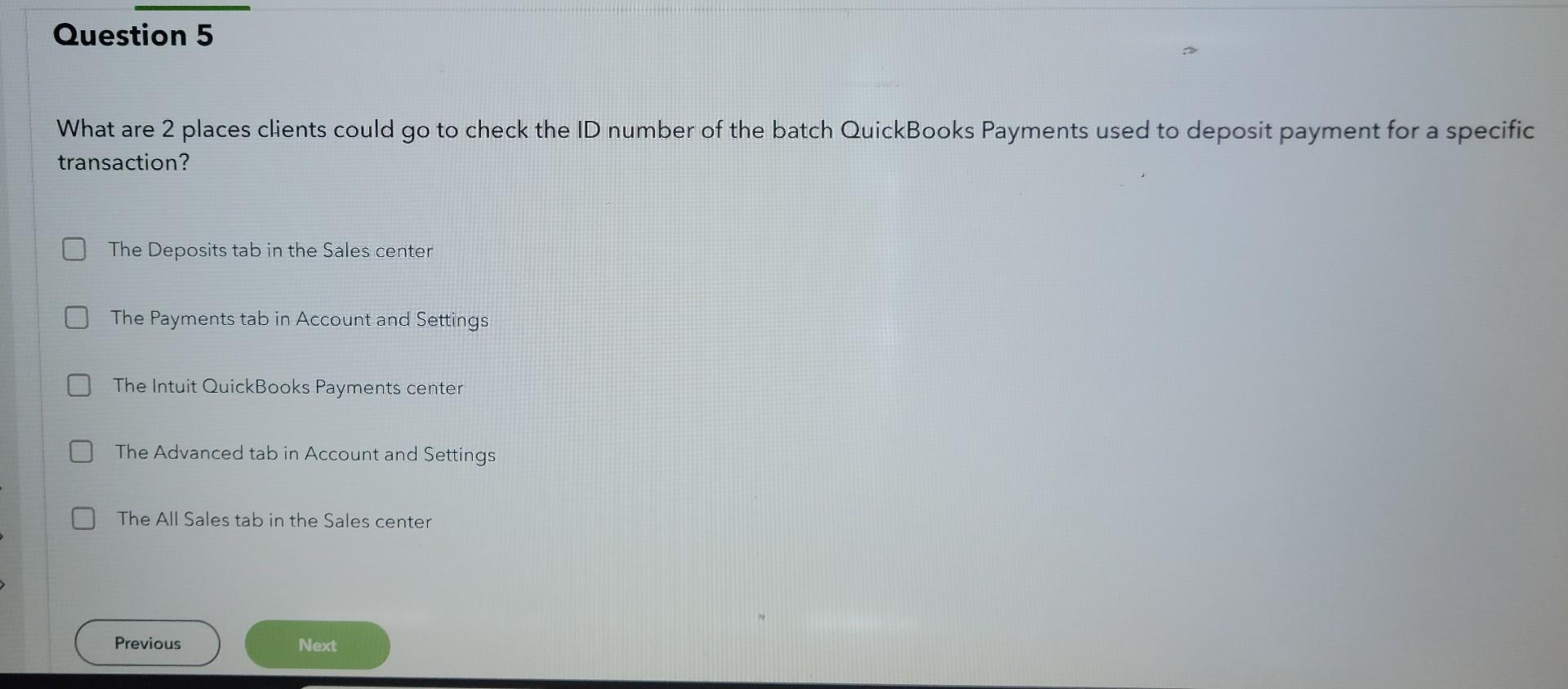

Solved What are 2 places clients could go to check the ID

Here's what to do if. Clear the direct debit information ; Learn what to do if your taxpayer info is wrong. You can pay instantly on the irs make a payment page. We'll create the form 1099 for you on or before january 31.

QuickBooks Payments Integration chargezoom

Here's what to do if. You can pay instantly on the irs make a payment page. Learn what to do if your taxpayer info is wrong. Clear the direct debit information ; If something goes wrong, we're here to help.

Setup Recurring ACH Payments In QuickBooks Easy Steps

Clear the direct debit information ; You can pay instantly on the irs make a payment page. If something goes wrong, we're here to help. We'll create the form 1099 for you on or before january 31. Learn what to do if your taxpayer info is wrong.

Howto Guide for Accepting Payments with QuickBooks Tipalti

You can pay instantly on the irs make a payment page. Learn what to do if your taxpayer info is wrong. We'll create the form 1099 for you on or before january 31. Here's what to do if. Clear the direct debit information ;

QuickBooks Payments Integration chargezoom

Here's what to do if. If something goes wrong, we're here to help. We'll create the form 1099 for you on or before january 31. You can pay instantly on the irs make a payment page. Clear the direct debit information ;

QuickBooks Payments Review Is It Right for Your Business?

If something goes wrong, we're here to help. You can pay instantly on the irs make a payment page. Quickbooks payments is available at an additional cost. Clear the direct debit information ; We'll create the form 1099 for you on or before january 31.

Learn What To Do If Your Taxpayer Info Is Wrong.

Here's what to do if. You can pay instantly on the irs make a payment page. Clear the direct debit information ; We'll create the form 1099 for you on or before january 31.

If Something Goes Wrong, We're Here To Help.

Quickbooks payments is available at an additional cost.